Question: Question 32 - Answer all parts a) Olde ple designs and manufactures shoes, Olde plc can select only one of two projects each of which

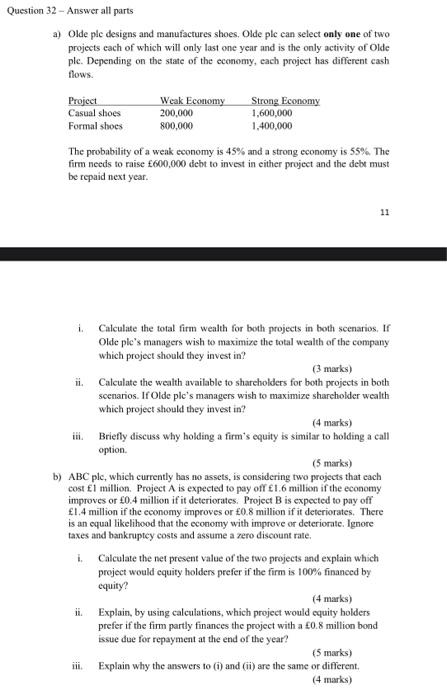

Question 32 - Answer all parts a) Olde ple designs and manufactures shoes, Olde plc can select only one of two projects each of which will only last one year and is the only activity of Olde ple. Depending on the state of the economy, each project has different eash flows. The probability of a weak economy is 45% and a strong economy is 55%. The firm needs to raise f(600,000 debt to invest in either project and the debt must be repaid next year. 11 i. Calculate the total firm wealth for both projects in both scenarios, If Olde ple's managers wish to maximize the total wealth of the company which project should they invest in? (3 marks) ii. Calculate the wealth available to sharcholders for both projects in both scenarios. If Olde ple's managers wish to maximize shareholder wealth which project should they invest in? (4 marks) iii. Briefly discuss why holding a firm's equity is similar to bolding a call option. (5 marks) b) ABC ple, which currently has no assets, is considering two projects that each improves or 0.4 million if it deteriorates. Project B is expected to pay off fl.4 million if the economy improves or 0.8 million if it deteriorates. There is an equal likelihood that the economy with improve or deteriorate. Ignore taxes and bankruptcy costs and assume a zero discount rate. i. Calculate the net present value of the two projects and explain which project would equity holders prefer if the firm is 100% financed by equity? (4 marks) ii. Explain, by using calculations, which project would equity holders prefer if the firm partly finances the project with a 0.8 million bond issue due for repayment at the end of the year? (5 marks) iii. Explain why the answers to (i) and (ii) are the same or different. (4 marks)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts