Question: QUESTION 32 - LOAN AMORTIZATION (20 MARKS) Time left 2:24:28 Jonathan wishes to borrow $180 000 from a commercial bank. He was told that the

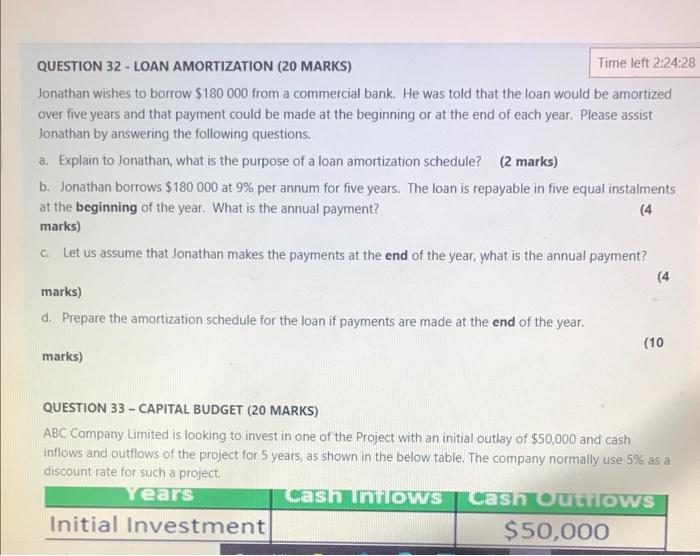

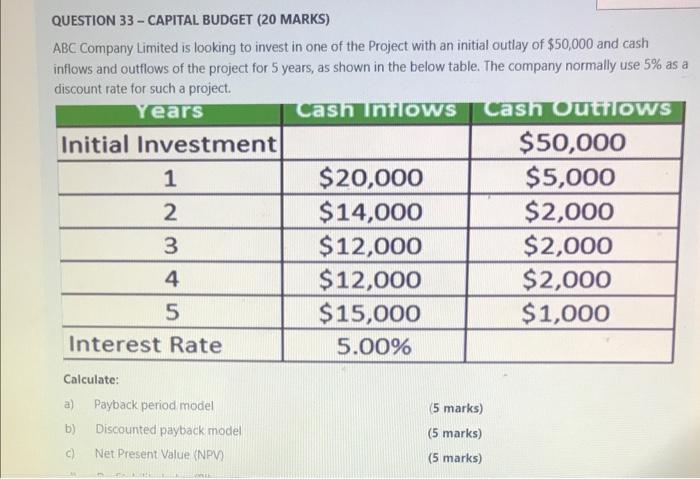

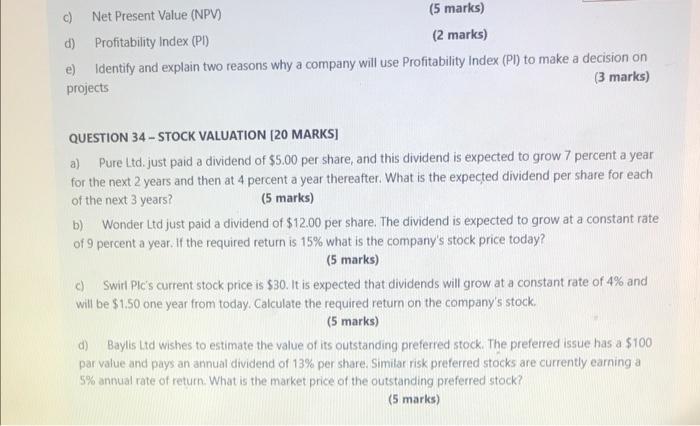

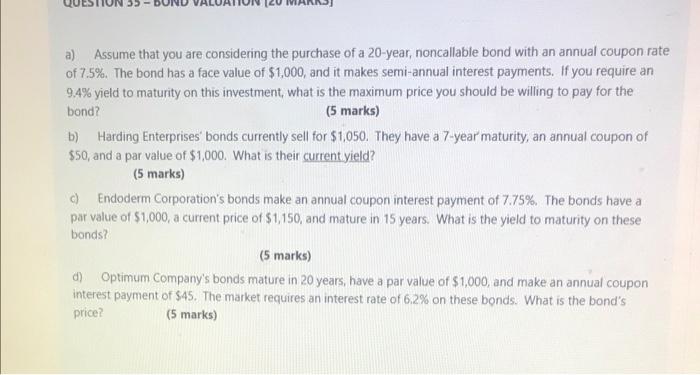

QUESTION 32 - LOAN AMORTIZATION (20 MARKS) Time left 2:24:28 Jonathan wishes to borrow $180 000 from a commercial bank. He was told that the loan would be amortized over five years and that payment could be made at the beginning or at the end of each year. Please assist Jonathan by answering the following questions. a. Explain to Jonathan, what is the purpose of a loan amortization schedule? (2 marks) b. Jonathan borrows $180 000 at 9% per annum for five years. The loan is repayable in five equal instalments at the beginning of the year. What is the annual payment? (4 marks) c. Let us assume that Jonathan makes the payments at the end of the year, what is the annual payment? (4 marks) d. Prepare the amortization schedule for the loan if payments are made at the end of the year. (10 marks) QUESTION 33 - CAPITAL BUDGET (20 MARKS) ABC Company Limited is looking to invest in one of the Project with an initial outlay of $50,000 and cash inflows and outflows of the project for 5 years, as shown in the below table. The company normally use 5% as a discount rate for such a project. Years Cash Inflows Cash Outflows Initial Investment $50,000 QUESTION 33 - CAPITAL BUDGET (20 MARKS) ABC Company Limited is looking to invest in one of the Project with an initial outlay of $50,000 and cash inflows and outflows of the project for 5 years, as shown in the below table. The company normally use 5% as a discount rate for such a project. Years Cash Inflows Cash Outflows Initial Investment $50,000 1 $20,000 $5,000 2 $14,000 $2,000 3 $12,000 $2,000 4 $12,000 $2,000 5 $15,000 $1,000 Interest Rate 5.00% Calculate: a) Payback period model b) Discounted payback model c) Net Present Value (NPV) WOLLE (5 marks) (5 marks) (5 marks) Net Present Value (NPV) (5 marks) (2 marks) d) Profitability Index (Pl) e) Identify and explain two reasons why a company will use Profitability Index (PI) to make a decision on projects (3 marks) QUESTION 34-STOCK VALUATION [20 MARKS] a) Pure Ltd. just paid a dividend of $5.00 per share, and this dividend is expected to grow 7 percent a year for the next 2 years and then at 4 percent a year thereafter. What is the expected dividend per share for each of the next 3 years? (5 marks) b) Wonder Ltd just paid a dividend of $12.00 per share. The dividend is expected to grow at a constant rate of 9 percent a year. If the required return is 15% what is the company's stock price today? (5 marks) c) Swirl Pic's current stock price is $30. It is expected that dividends will grow at a constant rate of 4% and will be $1.50 one year from today. Calculate the required return on the company's stock. (5 marks) d) Baylis Ltd wishes to estimate the value of its outstanding preferred stock. The preferred issue has a $100 par value and pays an annual dividend of 13% per share. Similar risk preferred stocks are currently earning a 5% annual rate of return. What is the market price of the outstanding preferred stock? (5 marks) a) Assume that you are considering the purchase of a 20-year, noncallable bond with an annual coupon rate of 7.5%. The bond has a face value of $1,000, and it makes semi-annual interest payments. If you require an 9.4% yield to maturity on this investment, what is the maximum price you should be willing to pay for the bond? (5 marks) b) Harding Enterprises bonds currently sell for $1,050. They have a 7-year maturity, an annual coupon of $50, and a par value of $1,000. What is their current yield? (5 marks) c) Endoderm Corporation's bonds make an annual coupon interest payment of 7.75%. The bonds have a par value of $1,000, a current price of $1,150, and mature in 15 years. What is the yield to maturity on these bonds? (5 marks) d) Optimum Company's bonds mature in 20 years, have a par value of $1,000, and make an annual coupon interest payment of $45. The market requires an interest rate of 6.2% on these bonds. What is the bond's price

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts