Question: QUESTION 32 On January 1, 2019. Declan Duper Co. declared a $2.00 per share dividend payable on February 1, to holders of record on January

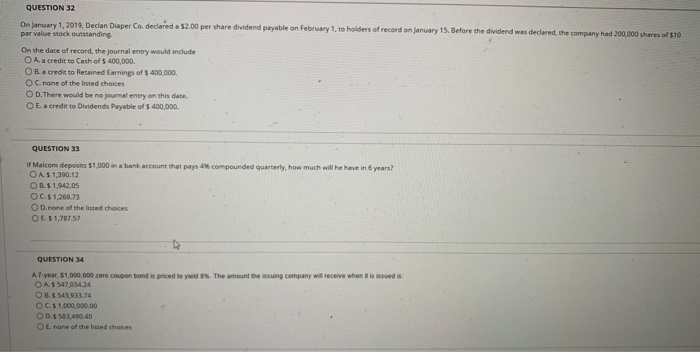

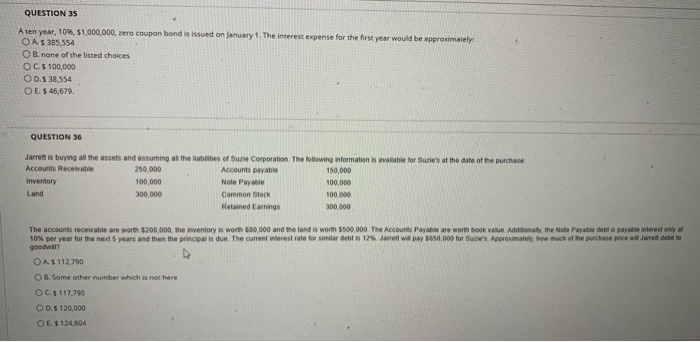

QUESTION 32 On January 1, 2019. Declan Duper Co. declared a $2.00 per share dividend payable on February 1, to holders of record on January 15. Before the dividend was declared the company had 200,000 shares of $10 par value stock outstanding On the date of record, the journal entry would include O A. a credit to Cash of $400,000 OB. a credit to Retained Earnings of $ 400.000 O none of the listed choices OD. There would be no journal entry on this date O E a credit to Dividends Payable of $400,000 QUESTION 3 compounded quarterly, how much will If Malcom deposit $1.000 a bank account that pays OA 1,390.12 OB. 51.902.05 OC$ 1.260.73 OD none of the choices OLS1775 QUESTION 14 bond pric e The company When AT 500 000 OAS 54703424 OBS 54103174 OCs 1000,000.00 OD 581,490.40 E nonetheted chce QUESTION 35 A ten year, 10%, 51,000,000, sero coupon bond is issued on January 1. The interest expense for the first year would be approximately OAS 385,554 O B. none of the listed choices OC$100,000 OD.5 38,554 O E $46,679. QUESTION 36 Jarrett is buying all the assets and assuming all the liabilities of Suzie Corporation The following information is available for Sure's at the date of the purchase Accounts Receivable 250,000 Accounts payable 150,000 Inventory 100 000 Note Payable 100,000 Land 300,000 Common Stock 100 000 Retained Earrings 300 000 The accounts receivable are worth $200,000, the inventory is worth $80.000 and the land is worth 500.000 The Accounts Payable are worth book value Additionally the Note Payable debitis payable interest any 10% per year for the next 5 years and then the principal is due. The current interest rate for similar deb 12 Jarrell will pay 50,000 for Sue'sApproximately, how much of the purchase price will Jarret debit to goodwill? O A $112.790 6. Some other number which is not here OC. $ 117,790 OD.S 120,000 O E $ 124,804

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts