Question: QUESTION 32 You are considering purchasing a small office building for $1.875.000. The expected first year potential gross income is $450,000 with a canelons GO

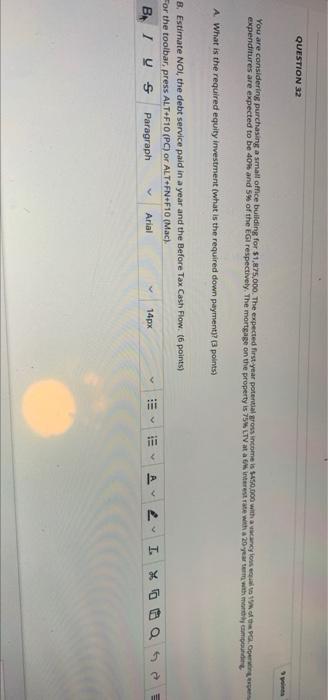

QUESTION 32 You are considering purchasing a small office building for $1.875.000. The expected first year potential gross income is $450,000 with a canelons GO expenditures are expected to be 40 and 5% of the Ei respectively. The mortgage on the property is 75% LTV ata o interest rate with a 20-year term tham A What is the required equity investment (what is the required down paymenty? (3 points) 8. Estimate NOI, the debt service paid in a year and the Before Tax Cash Flow. (6 points) For the toolbar, press ALT+F10 (PC) or ALT+FN+F10 (Mac). By I us Paragraph Arial 14px > | I. XOQ QUESTION 32 You are considering purchasing a small office building for $1.875.000. The expected first year potential gross income is $450,000 with a canelons GO expenditures are expected to be 40 and 5% of the Ei respectively. The mortgage on the property is 75% LTV ata o interest rate with a 20-year term tham A What is the required equity investment (what is the required down paymenty? (3 points) 8. Estimate NOI, the debt service paid in a year and the Before Tax Cash Flow. (6 points) For the toolbar, press ALT+F10 (PC) or ALT+FN+F10 (Mac). By I us Paragraph Arial 14px > | I. XO

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts