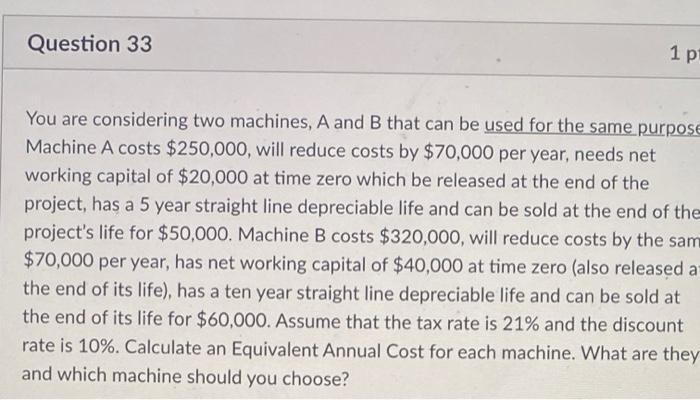

Question: Question 33 1 p You are considering two machines, A and B that can be used for the same purpose Machine A costs $250,000, will

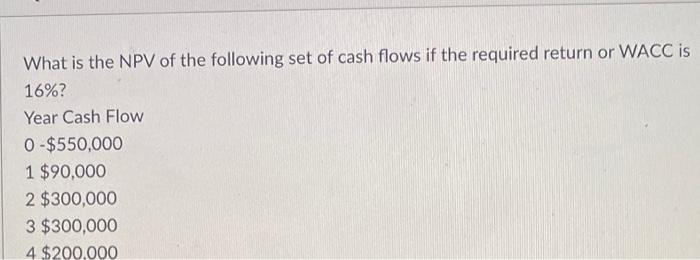

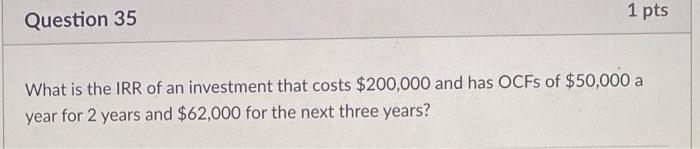

Question 33 1 p You are considering two machines, A and B that can be used for the same purpose Machine A costs $250,000, will reduce costs by $70,000 per year, needs net working capital of $20,000 at time zero which be released at the end of the project, has a 5 year straight line depreciable life and can be sold at the end of the project's life for $50,000. Machine B costs $320,000, will reduce costs by the sam $70,000 per year, has net working capital of $40,000 at time zero (also released a the end of its life), has a ten year straight line depreciable life and can be sold at the end of its life for $60,000. Assume that the tax rate is 21% and the discount rate is 10%. Calculate an Equivalent Annual Cost for each machine. What are they and which machine should you choose? What is the NPV of the following set of cash flows if the required return or WACC is 16%? Year Cash Flow 0-$550,000 1 $90,000 2 $300,000 3 $300,000 4 $200.000 1 pts Question 35 What is the IRR of an investment that costs $200,000 and has OCFs of $50,000 a year for 2 years and $62,000 for the next three years

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts