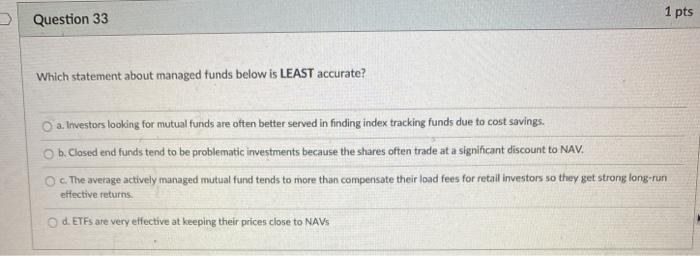

Question: Question 33 1 pts Which statement about managed funds below is LEAST accurate? a. Investors looking for mutual funds are often better served in finding

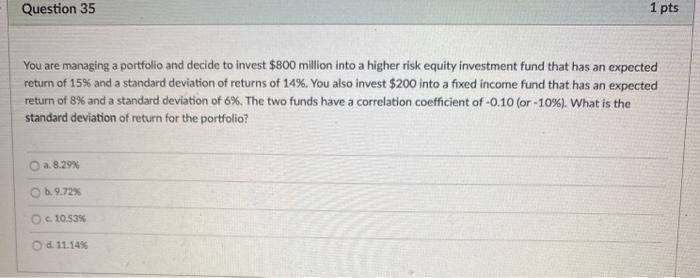

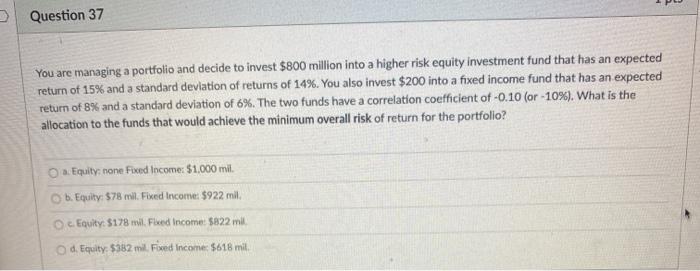

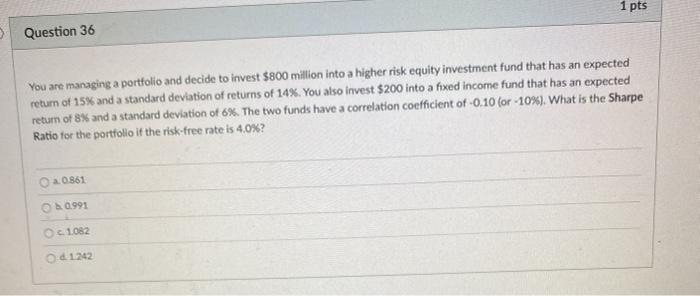

Question 33 1 pts Which statement about managed funds below is LEAST accurate? a. Investors looking for mutual funds are often better served in finding index tracking funds due to cost savings. ob Closed end funds tend to be problematic investments because the shares often trade at a significant discount to NAV. c. The average actively managed mutual fund tends to more than compensate their load fees for retail investors so they get strong long-run effective returns d. ETFs are very effective at keeping their prices close to NAVS Question 35 1 pts You are managing a portfolio and decide to invest $800 million into a higher risk equity investment fund that has an expected return of 15% and a standard deviation of returns of 14%. You also invest $200 into a fixed income fund that has an expected return of 8% and a standard deviation of 6%. The two funds have a correlation coefficient of -0.10 (or -10%). What is the standard deviation of return for the portfolio? a. 8.29% b. 9.72% c. 10.53% d. 11.145 Question 37 You are managing a portfolio and decide to invest $800 million into a higher risk equity investment fund that has an expected return of 15% and a standard deviation of returns of 14%. You also invest $200 into a fixed income fund that has an expected return of 8% and a standard deviation of 6%. The two funds have a correlation coefficient of -0.10 (or -10%). What is the allocation to the funds that would achieve the minimum overall risk of return for the portfolio? on Equity, none Foxed Income: $1,000 mil. b. Equity: 578 mil. Fixed Income: $922 mil. c. Equity: $178 nl. Flved Income: 5822 mil d. Equity 5382 mil. Fixed Income: $618 mit. 1 pts Question 36 You are managing a portfolio and decide to invest $800 million into a higher risk equity investment fund that has an expected return of 15% and a standard deviation of returns of 14%. You also invest $200 into a fixed income fund that has an expected return of 8% and a standard deviation of 6%. The two funds have a correlation coefficient of -0.10 (or 10%). What is the Sharpe Ratio for the portfolio if the risk-free rate is 4.0%? 2 0861 $0.991 . 1082 Od 1242

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts