Question: Question 33 1 pts You are considering two machines, A and B that can be used for the same purpose. Machine A costs $250,000, will

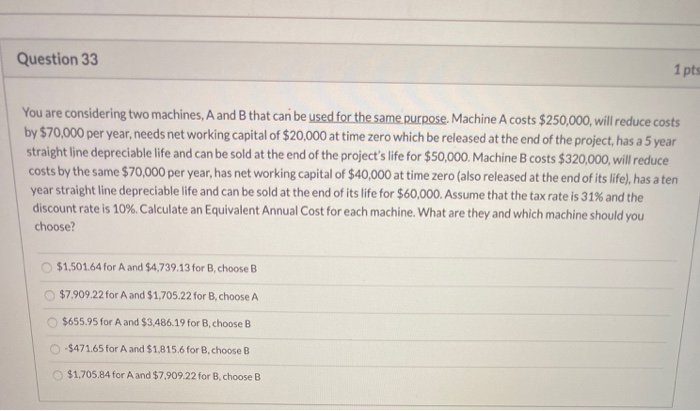

Question 33 1 pts You are considering two machines, A and B that can be used for the same purpose. Machine A costs $250,000, will reduce costs by $70,000 per year, needs net working capital of $20,000 at time zero which be released at the end of the project has a 5 year straight line depreciable life and can be sold at the end of the project's life for $50,000. Machine B costs $320,000, will reduce costs by the same $70,000 per year, has net working capital of $40,000 at time zero (also released at the end of its life), has a ten year straight line depreciable life and can be sold at the end of its life for $60,000. Assume that the tax rate is 31% and the discount rate is 10%. Calculate an Equivalent Annual Cost for each machine. What are they and which machine should you choose? $1.501.64 for A and $4,739.13 for B, choose B $7.909.22 for A and $1,705.22 for B, choose A $655.95 for A and $3,486,19 for B, choose B -$471.65 for A and $1,815.6 for B, choose B $1,705.84 for A and $7.909.22 for B, choose B

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts