Question: Question 33 2 pts A company is considering two different proposals for computing the bonus for its new company president. The first plan states that

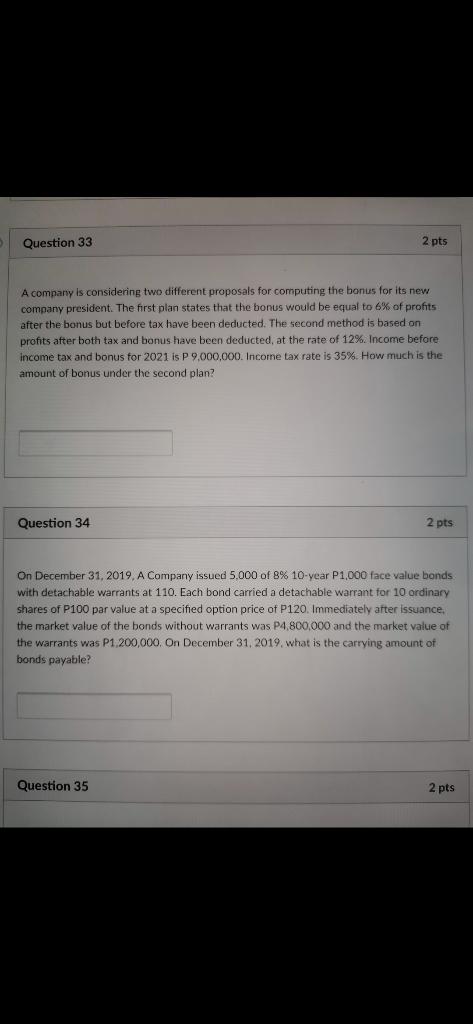

Question 33 2 pts A company is considering two different proposals for computing the bonus for its new company president. The first plan states that the bonus would be equal to 6% of profits after the bonus but before tax have been deducted. The second method is based on profits after both tax and bonus have been deducted, at the rate of 12%. Income before income tax and bonus for 2021 is P 9,000,000. Income tax rate is 35%. How much is the amount of bonus under the second plan? Question 34 2 pts On December 31, 2019, A Company issued 5.000 of 8% 10-year P1,000 face value bonds with detachable warrants at 110. Each bond carried a detachable warrant for 10 ordinary shares of P100 par value at a specified option price of P120. Immediately after Issuance. the market value of the bonds without warrants was P4.800,000 and the market value of the warrants was P1.200,000. On December 31, 2019. what is the carrying amount of bonds payable? Question 35 2 pts

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts