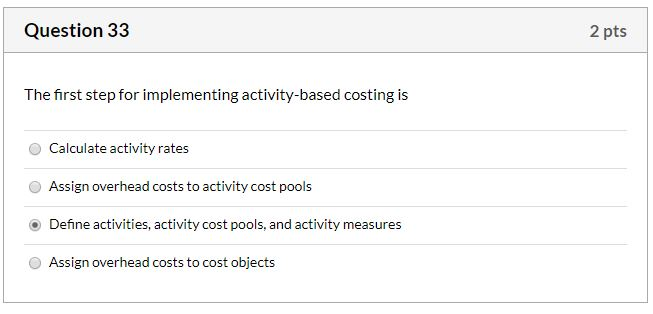

Question: Question 33 2 pts The first step for implementing activity-based costing is Calculate activity rates Assign overhead costs to activity cost pools Define activities, activity

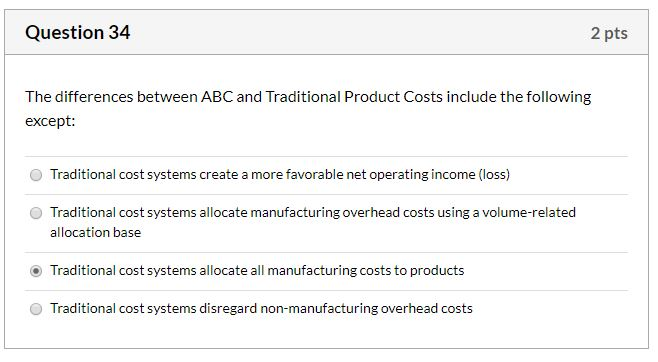

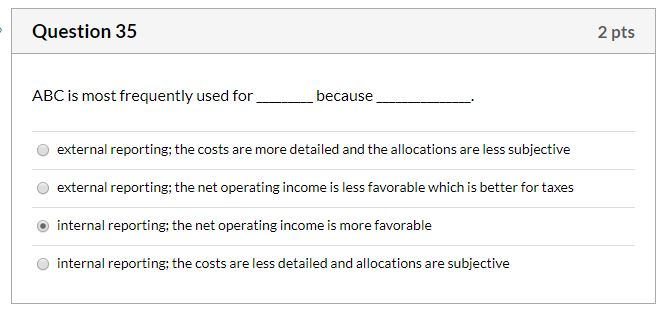

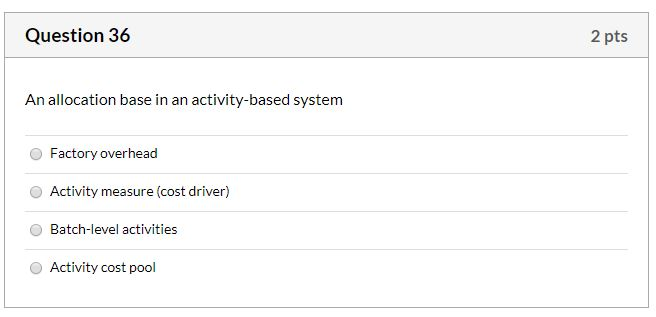

Question 33 2 pts The first step for implementing activity-based costing is Calculate activity rates Assign overhead costs to activity cost pools Define activities, activity cost pools, and activity measures Assign overhead costs to cost objects Question 34 2 pts The differences between ABC and Traditional Product Costs include the following except: Traditional cost systems create a more favorable net operating income (loss) Traditional cost systems allocate manufacturing overhead costs using a volume-related allocation base Traditional cost systems allocate all manufacturing costs to products Traditional cost systems disregard non-manufacturing overhead costs Question 35 2 pts ABC is most frequently used for __because external reporting; the costs are more detailed and the allocations are less subjective external reporting; the net operating income is less favorable which is better for taxes internal reporting; the net operating income is more favorable internal reporting; the costs are less detailed and allocations are subjective Question 36 2 pts An allocation base in an activity-based system Factory overhead Activity measure (cost driver) Batch-level activities Activity cost pool

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts