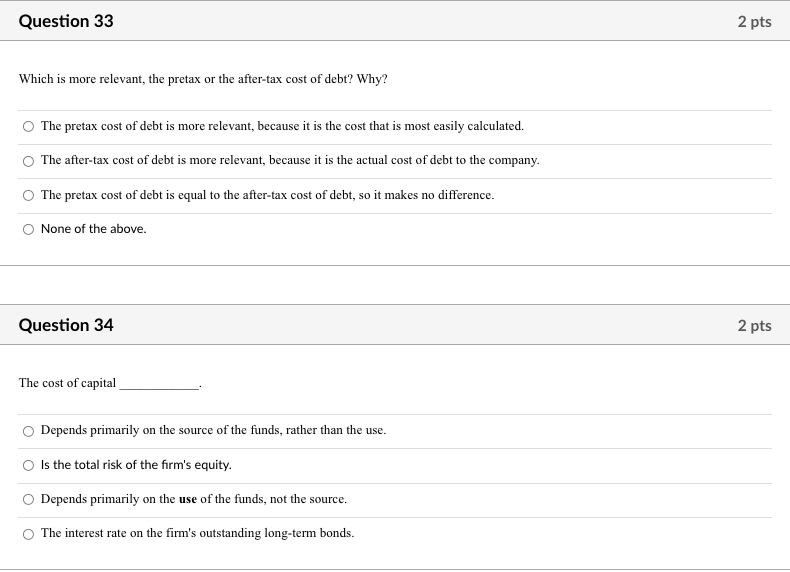

Question: Question 33 2 pts Which is more relevant, the pretax or the after-tax cost of debt? Why? The pretax cost of debt is more relevant,

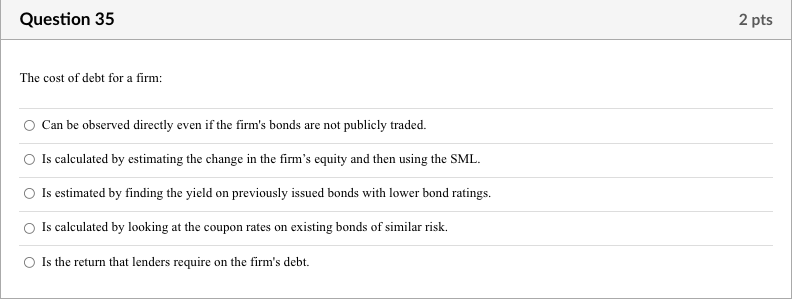

Question 33 2 pts Which is more relevant, the pretax or the after-tax cost of debt? Why? The pretax cost of debt is more relevant, because it is the cost that is most easily calculated. m The after-tax cost of debt is more relevant, because it is the actual cost of debt to the company. The pretax cost of debt is equal to the after-tax cost of debt, so it makes no difference. None of the above. Question 34 2 pts The cost of capital Depends primarily on the source of the funds, rather than the use. Is the total risk of the firm's equity. Depends primarily on the use of the funds, not the source. The interest rate on the firm's outstanding long-term bonds. Question 35 2 pts The cost of debt for a firm: Can be observed directly even if the firm's bonds are not publicly traded. Is calculated by estimating the change in the firm's equity and then using the SML. Is estimated by finding the yield on previously issued bonds with lower bond ratings. Is calculated by looking at the coupon rates on existing bonds of similar risk. Is the return that lenders require on the firm's debt

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts