Question: Question 33 Question 33 (3.3333 points) Listen EI Thompson, Inc. Balance Sheets For the years ending December 31, 2011 and 2012) Cash Accounts receivable Inventory

Question 33

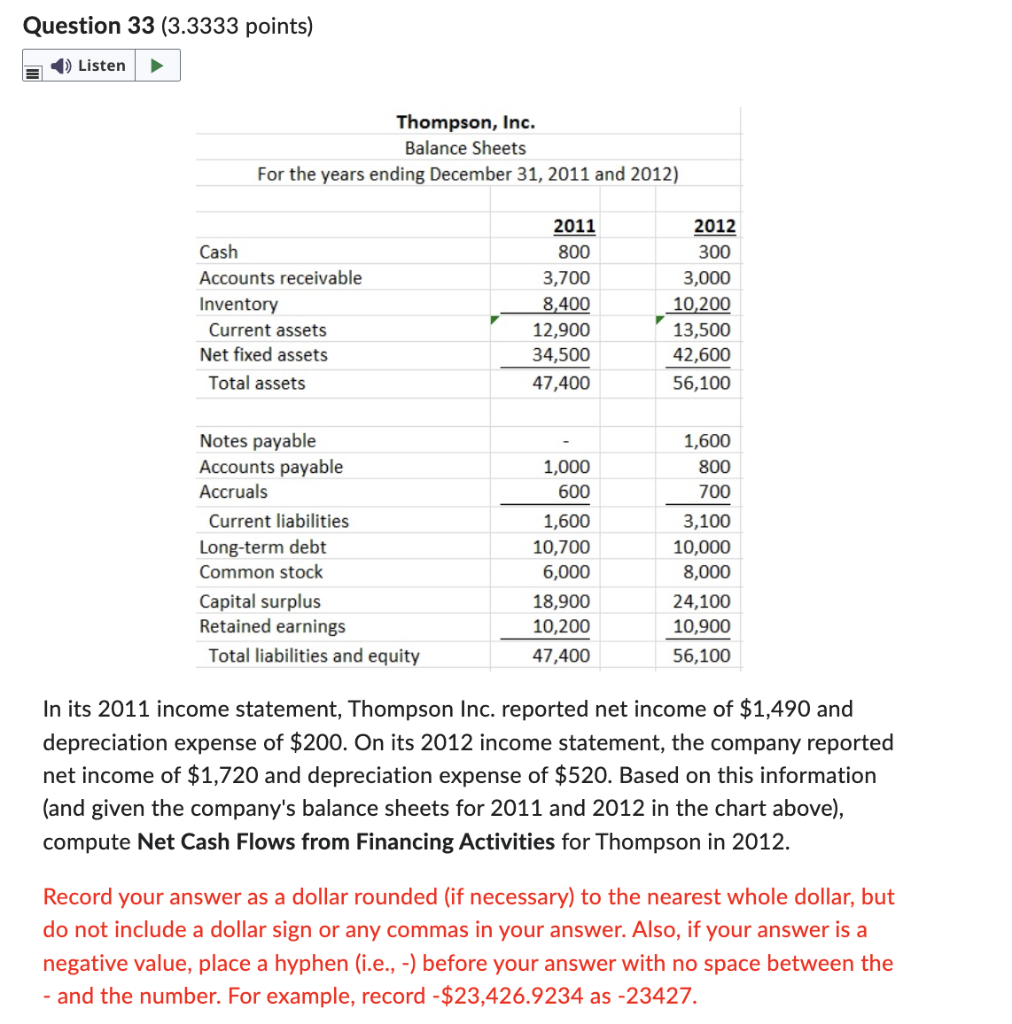

Question 33 (3.3333 points) Listen EI Thompson, Inc. Balance Sheets For the years ending December 31, 2011 and 2012) Cash Accounts receivable Inventory Current assets Net fixed assets Total assets Notes payable Accounts payable Accruals Current liabilities Long-term debt Common stock Capital surplus Retained earnings Total liabilities and equity 2011 800 3,700 8,400 12,900 34,500 47,400 1,000 600 1,600 10,700 6,000 18,900 10,200 47,400 2012 300 3,000 10,200 13,500 42,600 56,100 1,600 800 700 3,100 10,000 8,000 24,100 10,900 56,100 In its 2011 income statement, Thompson Inc. reported net income of $1,490 and depreciation expense of $200. On its 2012 income statement, the company reported net income of $1,720 and depreciation expense of $520. Based on this information (and given the company's balance sheets for 2011 and 2012 in the chart above), compute Net Cash Flows from Financing Activities for Thompson in 2012. Record your answer as a dollar rounded (if necessary) to the nearest whole dollar, but do not include a dollar sign or any commas in your answer. Also, if your answer is a negative value, place a hyphen (i.e., -) before your answer with no space between the - and the number. For example, record -$23,426.9234 as -23427

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts