Question: Question 34 (1 point) What is the maximum amount you should pay today for an investment that pays a single future cash flow of $25,000

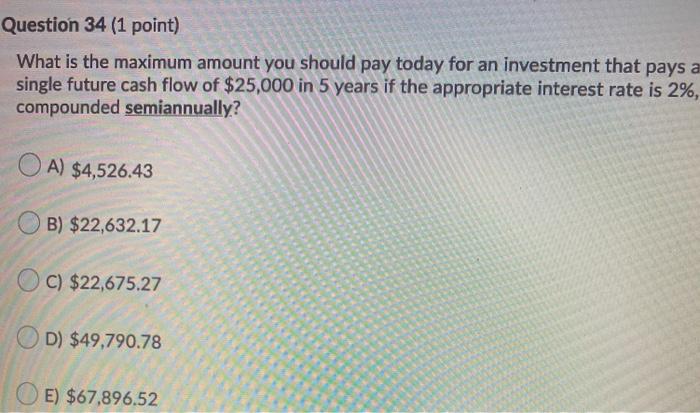

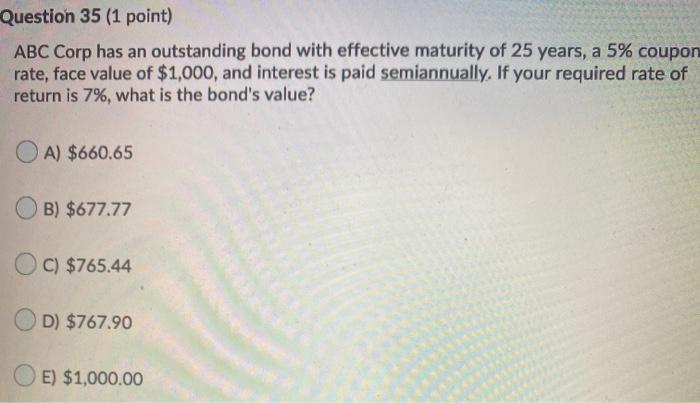

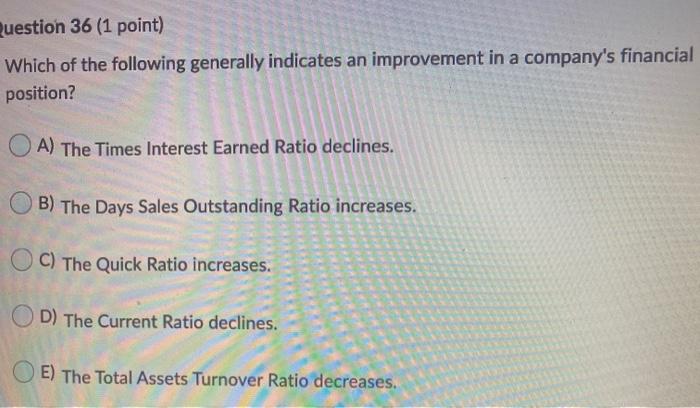

Question 34 (1 point) What is the maximum amount you should pay today for an investment that pays a single future cash flow of $25,000 in 5 years if the appropriate interest rate is 2%, compounded semiannually? OA) $4,526.43 B) $22,632.17 C) $22,675.27 D) $49,790.78 E) $67,896.52 Question 35 (1 point) ABC Corp has an outstanding bond with effective maturity of 25 years, a 5% coupon rate, face value of $1,000, and interest is paid semiannually. If your required rate of return is 7%, what is the bond's value? A) $660.65 B) $677.77 OC) $765.44 D) $767.90 E) $1,000.00 Question 36 (1 point) Which of the following generally indicates an improvement in a company's financial position? A) The Times Interest Earned Ratio declines. B) The Days Sales Outstanding Ratio increases. C) The Quick Ratio increases. D) The Current Ratio declines. E) The Total Assets Turnover Ratio decreases

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts