Question: Question 34 10 points Save Answer Consider a four-year project with the following information: initial fixed asset investment = $620,000; straight-line depreciation to zero over

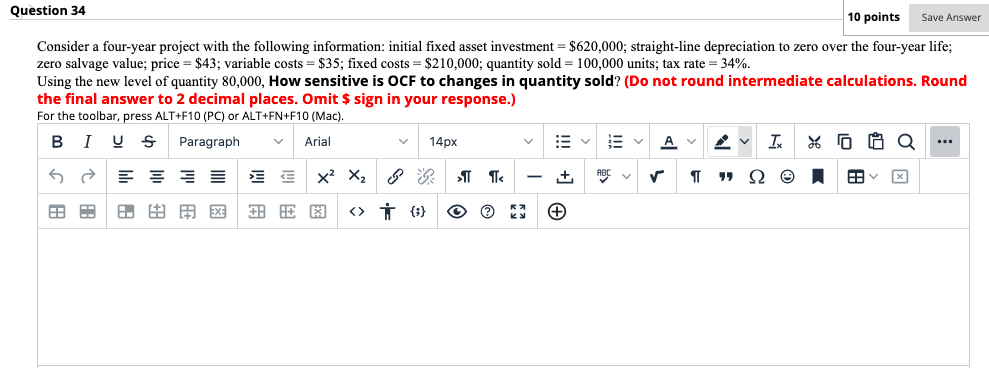

Question 34 10 points Save Answer Consider a four-year project with the following information: initial fixed asset investment = $620,000; straight-line depreciation to zero over the four-year life; zero salvage value; price = $43; variable costs = $35; fixed costs = $210,000; quantity sold = 100,000 units; tax rate = 34%. Using the new level of quantity 80,000, How sensitive is OCF to changes in quantity sold? (Do not round intermediate calculations. Round the final answer to 2 decimal places. Omit $ sign in your response.) For the toolbar, press ALT+F10 (PC) or ALT+FN+F10 (Mac). B I U Paragraph Arial 14px V IX X2 X ABC T " 2 E >> | {:}

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts