Question: QUESTION 34 2 points Save Answer On January 1, 2018. Jordan, Inc. acquired a machine for $1,100,000. The estimated useful life of the asset is

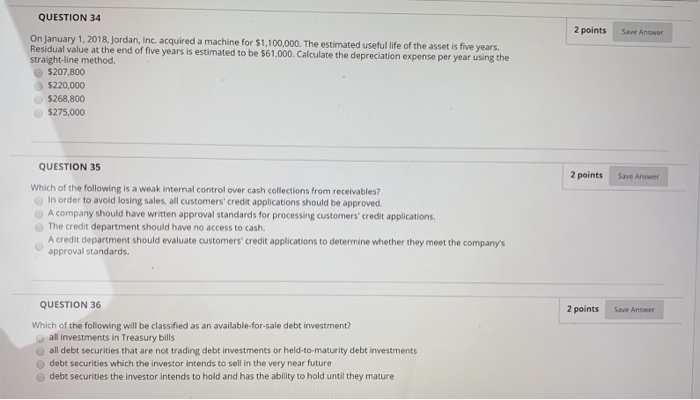

QUESTION 34 2 points Save Answer On January 1, 2018. Jordan, Inc. acquired a machine for $1,100,000. The estimated useful life of the asset is five years. Residual value at the end of five years is estimated to be $61.000. Calculate the depreciation expense per year using the straight-line method. $207,800 $220,000 5268,800 $275,000 QUESTION 35 2 points Save Answer Which of the following is a weak internal control over cash collections from receivables? In order to avoid losing sales, all customers' credit applications should be approved. A company should have written approval standards for processing customers' credit applications, The credit department should have no access to cash. A credit department should evaluate customers' credit applications to determine whether they meet the company's approval standards. QUESTION 36 2 points Save Answer Which of the following will be classified as an available-for-sale debt investment? all investments in Treasury bills all debt securities that are not trading debt investments or held-to-maturity debt investments debt securities which the investor intends to sell in the very near future debt securities the investor intends to hold and has the ability to hold until they mature

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts