Question: Question 34 (20 points) SHORT PROBLEM - CHAPTER 11 Brody Company sold interior decoration material to Jessica Company for 300,000 on December 1, 2019, with

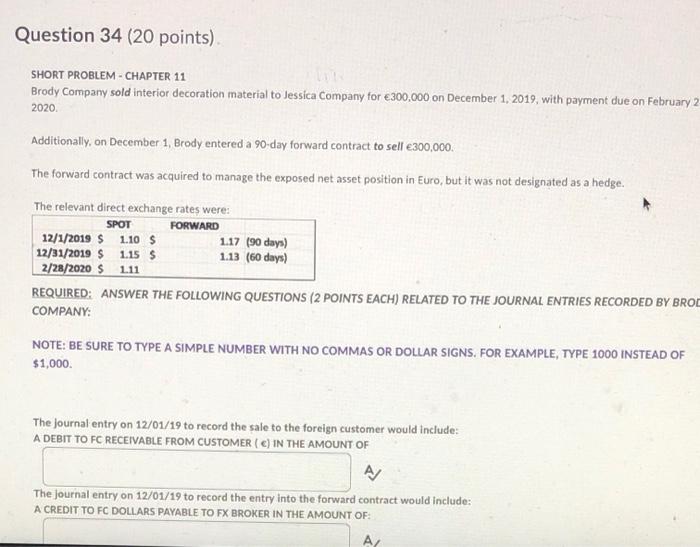

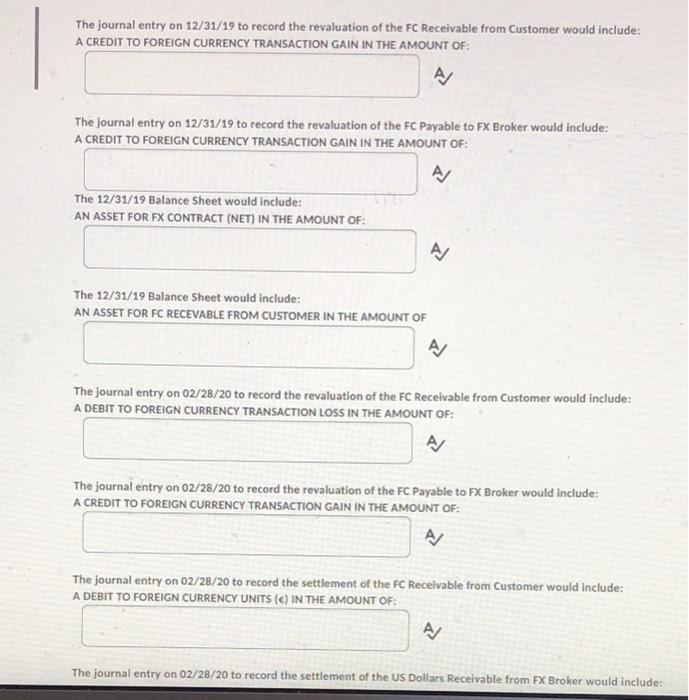

Question 34 (20 points) SHORT PROBLEM - CHAPTER 11 Brody Company sold interior decoration material to Jessica Company for 300,000 on December 1, 2019, with payment due on February 2 2020 Additionally, on December 1, Brody entered a 90-day forward contract to sell 300,000 The forward contract was acquired to manage the exposed net asset position in Euro, but it was not designated as a hedge. The relevant direct exchange rates were: SPOT FORWARD 12/1/2019 S 1.10 S 1.17 (90 days) 12/31/2019 $ 1.15 S 1.13 (60 days) 2/28/2020 $ 1.11 REQUIRED: ANSWER THE FOLLOWING QUESTIONS (2 POINTS EACH) RELATED TO THE JOURNAL ENTRIES RECORDED BY BROD COMPANY: NOTE: BE SURE TO TYPE A SIMPLE NUMBER WITH NO COMMAS OR DOLLAR SIGNS. FOR EXAMPLE, TYPE 1000 INSTEAD OF $1,000 The Journal entry on 12/01/19 to record the sale to the foreign customer would include: A DEBIT TO FC RECEIVABLE FROM CUSTOMER (C) IN THE AMOUNT OF The Journal entry on 12/01/19 to record the entry into the forward contract would include: A CREDIT TO FC DOLLARS PAYABLE TO FX BROKER IN THE AMOUNT OF: A The journal entry on 12/31/19 to record the revaluation of the FC Receivable from Customer would include: A CREDIT TO FOREIGN CURRENCY TRANSACTION GAIN IN THE AMOUNT OF: A The Journal entry on 12/31/19 to record the revaluation of the FC Payable to FX Broker would include: A CREDIT TO FOREIGN CURRENCY TRANSACTION GAIN IN THE AMOUNT OF: A The 12/31/19 Balance Sheet would include: AN ASSET FOR FX CONTRACT (NET) IN THE AMOUNT OF: A/ The 12/31/19 Balance Sheet would include: AN ASSET FOR FC RECEVABLE FROM CUSTOMER IN THE AMOUNT OF A The journal entry on 02/28/20 to record the revaluation of the FC Receivable from Customer would include: A DEBIT TO FOREIGN CURRENCY TRANSACTION LOSS IN THE AMOUNT OF: A The journal entry on 02/28/20 to record the revaluation of the FC Payable to FX Broker would include: A CREDIT TO FOREIGN CURRENCY TRANSACTION GAIN IN THE AMOUNT OF: A The journal entry on 02/28/20 to record the settlement of the FC Receivable from Customer would include: A DEBIT TO FOREIGN CURRENCY UNITS (C) IN THE AMOUNT OF: A The journal entry on 02/28/20 to record the settlement of the US Dollars Receivable from FX Broker would include: The Journal entry on 02/28/20 to record the settlement of the US Dollars Receivable from FX Broker would include: A DEBIT TO CASH IN THE AMOUNT OF: A Question 34 (20 points) SHORT PROBLEM - CHAPTER 11 Brody Company sold interior decoration material to Jessica Company for 300,000 on December 1, 2019, with payment due on February 2 2020 Additionally, on December 1, Brody entered a 90-day forward contract to sell 300,000 The forward contract was acquired to manage the exposed net asset position in Euro, but it was not designated as a hedge. The relevant direct exchange rates were: SPOT FORWARD 12/1/2019 S 1.10 S 1.17 (90 days) 12/31/2019 $ 1.15 S 1.13 (60 days) 2/28/2020 $ 1.11 REQUIRED: ANSWER THE FOLLOWING QUESTIONS (2 POINTS EACH) RELATED TO THE JOURNAL ENTRIES RECORDED BY BROD COMPANY: NOTE: BE SURE TO TYPE A SIMPLE NUMBER WITH NO COMMAS OR DOLLAR SIGNS. FOR EXAMPLE, TYPE 1000 INSTEAD OF $1,000 The Journal entry on 12/01/19 to record the sale to the foreign customer would include: A DEBIT TO FC RECEIVABLE FROM CUSTOMER (C) IN THE AMOUNT OF The Journal entry on 12/01/19 to record the entry into the forward contract would include: A CREDIT TO FC DOLLARS PAYABLE TO FX BROKER IN THE AMOUNT OF: A The journal entry on 12/31/19 to record the revaluation of the FC Receivable from Customer would include: A CREDIT TO FOREIGN CURRENCY TRANSACTION GAIN IN THE AMOUNT OF: A The Journal entry on 12/31/19 to record the revaluation of the FC Payable to FX Broker would include: A CREDIT TO FOREIGN CURRENCY TRANSACTION GAIN IN THE AMOUNT OF: A The 12/31/19 Balance Sheet would include: AN ASSET FOR FX CONTRACT (NET) IN THE AMOUNT OF: A/ The 12/31/19 Balance Sheet would include: AN ASSET FOR FC RECEVABLE FROM CUSTOMER IN THE AMOUNT OF A The journal entry on 02/28/20 to record the revaluation of the FC Receivable from Customer would include: A DEBIT TO FOREIGN CURRENCY TRANSACTION LOSS IN THE AMOUNT OF: A The journal entry on 02/28/20 to record the revaluation of the FC Payable to FX Broker would include: A CREDIT TO FOREIGN CURRENCY TRANSACTION GAIN IN THE AMOUNT OF: A The journal entry on 02/28/20 to record the settlement of the FC Receivable from Customer would include: A DEBIT TO FOREIGN CURRENCY UNITS (C) IN THE AMOUNT OF: A The journal entry on 02/28/20 to record the settlement of the US Dollars Receivable from FX Broker would include: The Journal entry on 02/28/20 to record the settlement of the US Dollars Receivable from FX Broker would include: A DEBIT TO CASH IN THE AMOUNT OF: A

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts