Question: Question 34 (8 points) 34. USE THE FOLLOWING GIVEN INFORMATION FOR QUESTIONS 34 AND 35. On January 1, 2010 Pod Company purchased 25% of the

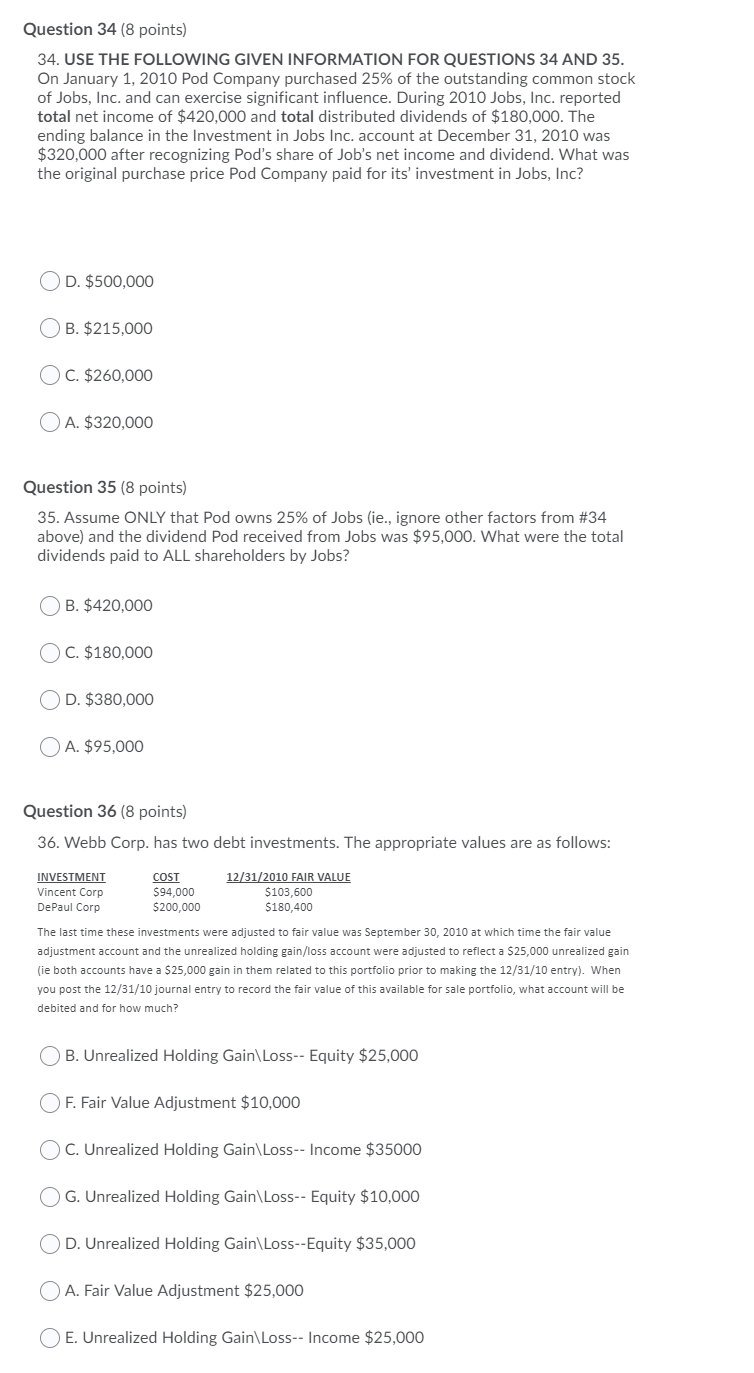

Question 34 (8 points) 34. USE THE FOLLOWING GIVEN INFORMATION FOR QUESTIONS 34 AND 35. On January 1, 2010 Pod Company purchased 25% of the outstanding common stock of Jobs, Inc. and can exercise significant influence. During 2010 Jobs, Inc. reported total net income of $420,000 and total distributed dividends of $180,000. The ending balance in the Investment in Jobs Inc. account at December 31, 2010 was $320,000 after recognizing Pod's share of Job's net income and dividend. What was the original purchase price Pod Company paid for its' investment in Jobs, Inc? D. $500,000 B. $215,000 C. $260.000 A. $320,000 Question 35 (8 points) 35. Assume ONLY that Pod owns 25% of Jobs (ie., ignore other factors from #34 above) and the dividend Pod received from Jobs was $95,000. What were the total dividends paid to ALL shareholders by Jobs? B. $420,000 C. $180,000 D. $380,000 A. $95,000 Question 36 (8 points) 36. Webb Corp. has two debt investments. The appropriate values are as follows: INVESTMENT Vincent Corp DePaul Corp COST $94,000 $200,000 12/31/2010 FAIR VALUE $103,600 $180,400 The last time these investments were adjusted to fair value was September 30, 2010 at which time the fair value adjustment account and the unrealized holding gain/loss account were adjusted to reflect a $25,000 unrealized gain (ie both accounts have a $25,000 gain in them related to this portfolio prior to making the 12/31/10 entry). When you post the 12/31/10 journal entry to record the fair value of this available for sale portfolio, what account will be debited and for how much? B. Unrealized Holding Gain Loss-- Equity $25,000 F. Fair Value Adjustment $10,000 C. Unrealized Holding Gain Loss-- Income $35000 G. Unrealized Holding Gain Loss-- Equity $10,000 o o D. Unrealized Holding Gain Loss--Equity $35,000 A. Fair Value Adjustment $25,000 E. Unrealized Holding Gain Loss-- Income $25,000

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts