Question: QUESTION 34 Alpha Finance Plc is considering replacing an old machine with a new machine. The following information is available on the capital structure of

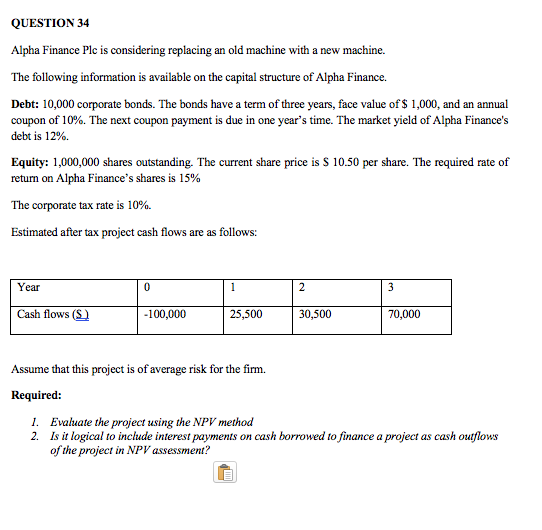

QUESTION 34 Alpha Finance Plc is considering replacing an old machine with a new machine. The following information is available on the capital structure of Alpha Finance. Debt: 10,000 corporate bonds. The bonds have a term of three years, face value of $ 1,000, and an annual coupon of 10%. The next coupon payment is due in one year's time. The market yield of Alpha Finance's debt is 12% Equity: 1,000,000 shares outstanding. The current share price is $ 10.50 per share. The required rate of return on Alpha Finance's shares is 15% The corporate tax rate is 10%. Estimated after tax project cash flows are as follows: Year 0 1 2 3 Cash flows () -100,000 25,500 30,500 70,000 Assume that this project is of average risk for the firm. Required: 1. Evaluate the project using the NPV method 2. Is it logical to include interest payments on cash borrowed to finance a project as cash outflows of the project in NPV assessment

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts