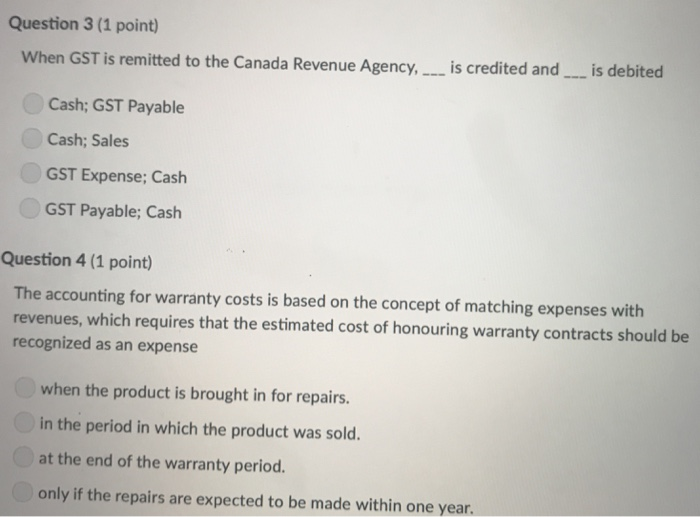

Question: Question 3.4.5 Question 3 (1 point When GST is remitted to the Canada Revenue Agency,.. is credited andis debited Cash; GST Payable Cash; Sales GST

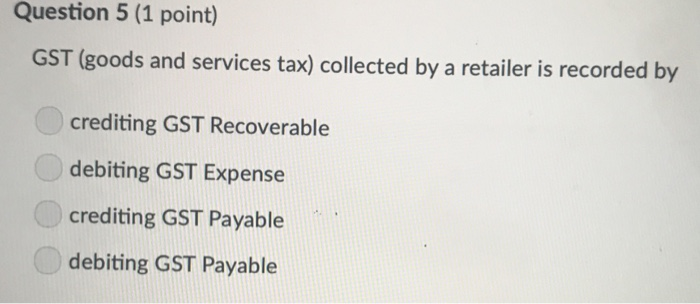

Question 3 (1 point When GST is remitted to the Canada Revenue Agency,.. is credited andis debited Cash; GST Payable Cash; Sales GST Expense; Cash GST Payable; Cash Question 4 (1 point The accounting for warranty costs is based on the concept of matching expenses with revenues, which requires that the estimated cost of honouring warranty contracts should be recognized as an expense when the product is brought in for repairs. in the period in which the product was sold. at the end of the warranty period. only if the repairs are expected to be made within one year Question 5 (1 point) GST (goods and services tax) collected by a retailer is recorded by crediting GST Recoverable debiting GST Expense crediting GST Payable debiting GST Payable

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts