Question: Question 35 (2.5 points) Which statement about portfolio diversification is most correct? 1) Proper diversification can reduce or eliminate systematic risk. 2) Diversification always reduces

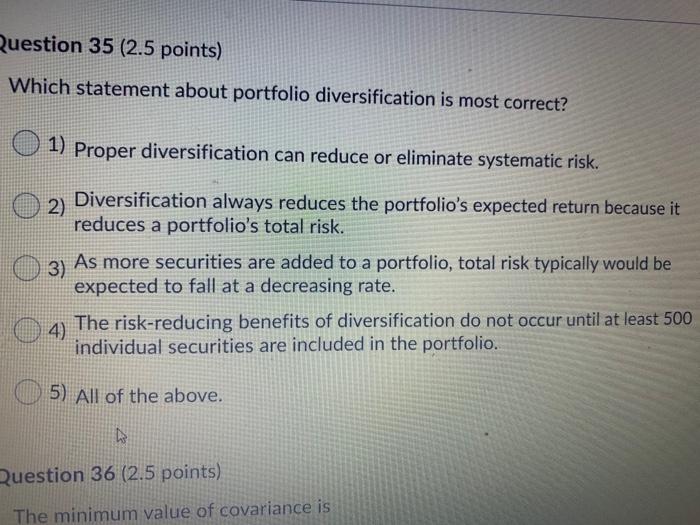

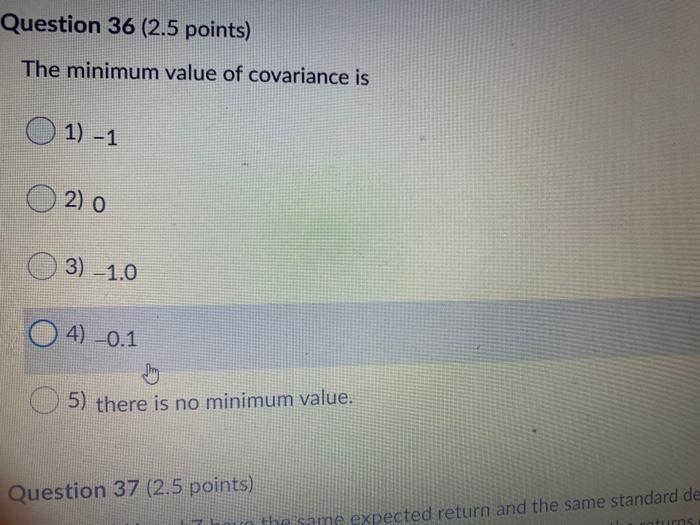

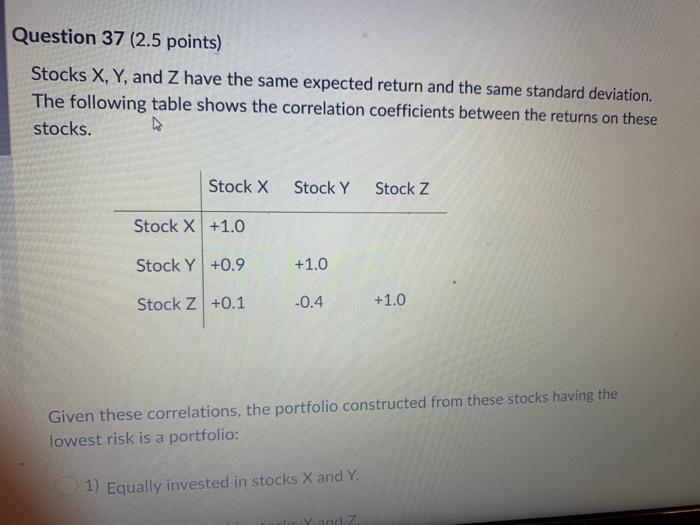

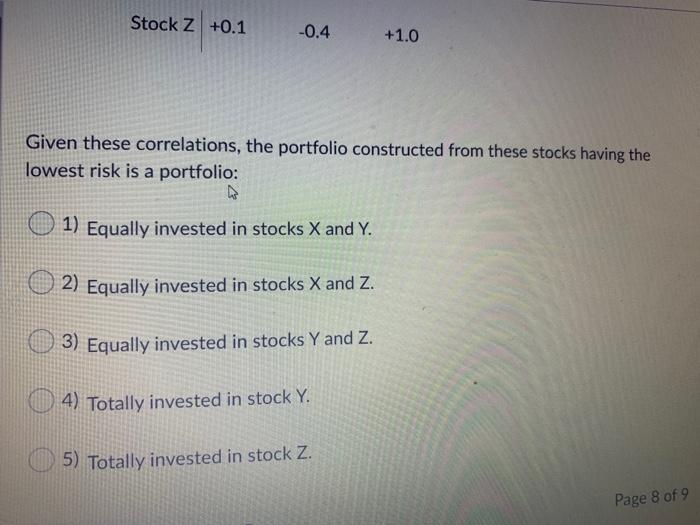

Question 35 (2.5 points) Which statement about portfolio diversification is most correct? 1) Proper diversification can reduce or eliminate systematic risk. 2) Diversification always reduces the portfolio's expected return because it reduces a portfolio's total risk. 3) As more securities are added to a portfolio, total risk typically would be expected to fall at a decreasing rate. O 4) The risk-reducing benefits of diversification do not occur until at least 500 individual securities are included in the portfolio. 5) All of the above. D Question 36 (2.5 points) The minimum value of covariance is Question 36 (2.5 points) The minimum value of covariance is 1) -1 2) o 3) -1.0 4) -0.1 5) there is no minimum value. Question 37 (2.5 points) the same expected return and the same standard de turns Question 37 (2.5 points) Stocks X, Y, and Z have the same expected return and the same standard deviation. The following table shows the correlation coefficients between the returns on these stocks. Stock X Stock Y Stock Z Stock X +1.0 Stock Y +0.9 +1.0 Stock Z +0.1 -0.4 +1.0 Given these correlations, the portfolio constructed from these stocks having the lowest risk a portfolio: 1) Equally invested in stocks X and Y. Y and Z Stock Z +0.1 -0.4 +1.0 Given these correlations, the portfolio constructed from these stocks having the lowest risk is a portfolio: 1) Equally invested in stocks X and Y. 2) Equally invested in stocks X and Z. 3) Equally invested in stocks Y and Z. 4) Totally invested in stock Y. 5) Totally invested in stock Z. Page 8 of 9

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts