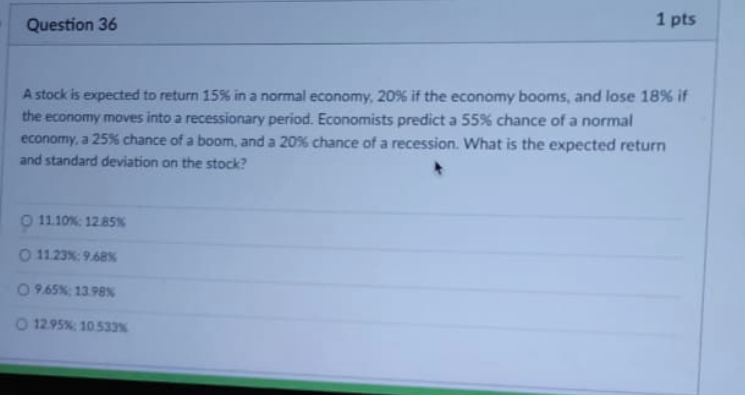

Question: Question 36 1 pts A stock is expected to return 15% in a normal economy, 20% if the economy booms, and lose 18% if the

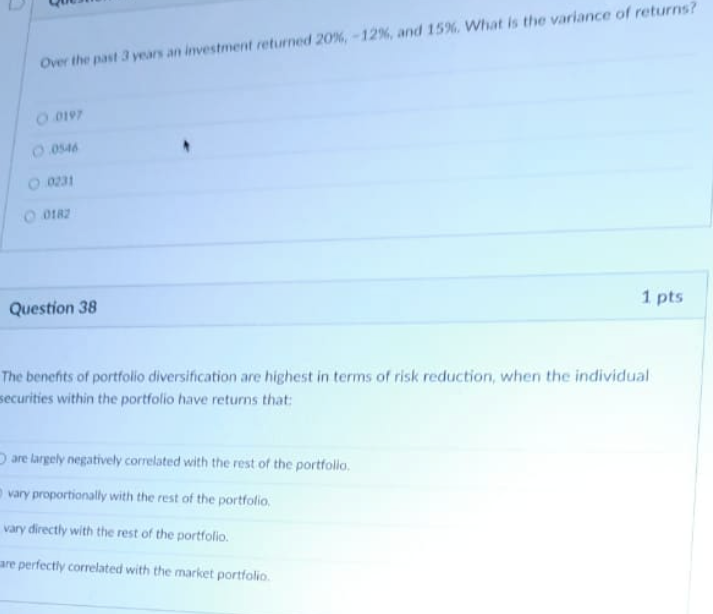

Question 36 1 pts A stock is expected to return 15% in a normal economy, 20% if the economy booms, and lose 18% if the economy moves into a recessionary period. Economists predict a 55% chance of a normal economy, a 25% chance of a boom, and a 20% chance of a recession. What is the expected return and standard deviation on the stock? 11.10%: 1285 11 23X: 9.68% 9.65%: 13.98 12.95%: 10 533 Over the past 3 years an investment returned 20%, 12%, and 15%. What is the variance of returns? 0.019 06 0331 012 1 pts Question 38 The benefits of portfolio diversification are highest in terms of risk reduction, when the individual securities within the portfolio have returns that are largely negatively correlated with the rest of the portfolio vary proportionally with the rest of the portfolio vary directly with the rest of the portfolio are perfectly correlated with the market portfolio

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts