Question: Question 36 2 points Fernando Designs is considering a project that has the following cash flow and WACC data. What is the project's discounted payback?

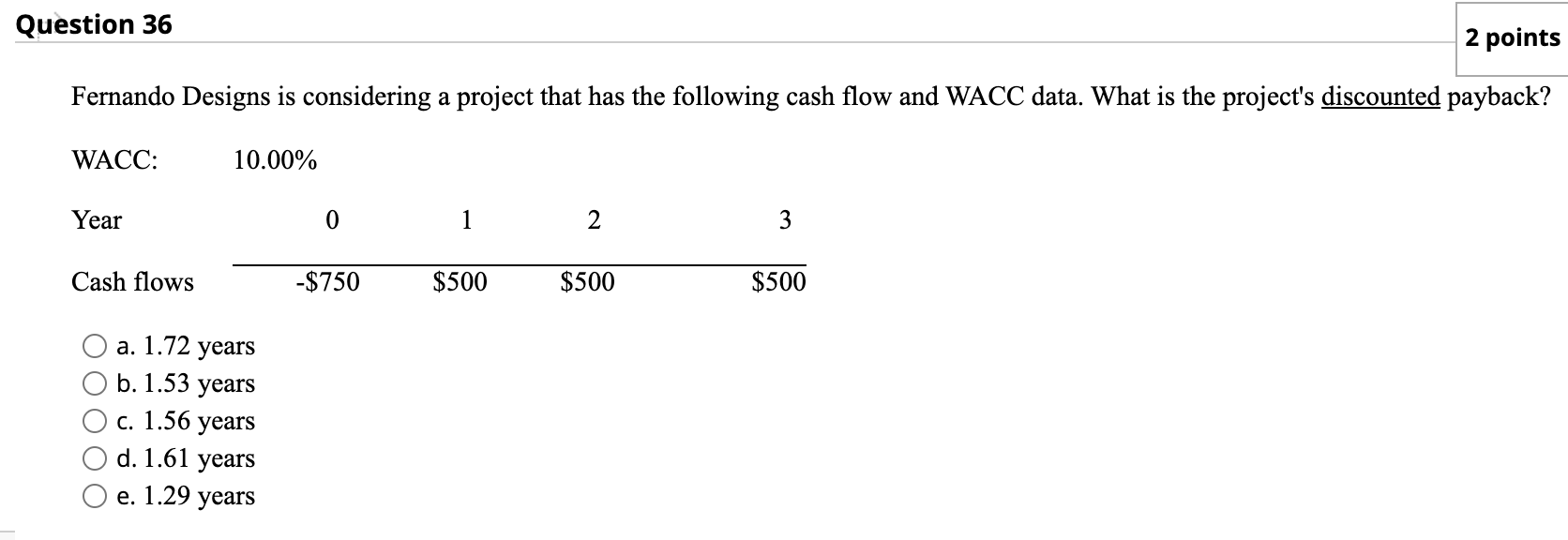

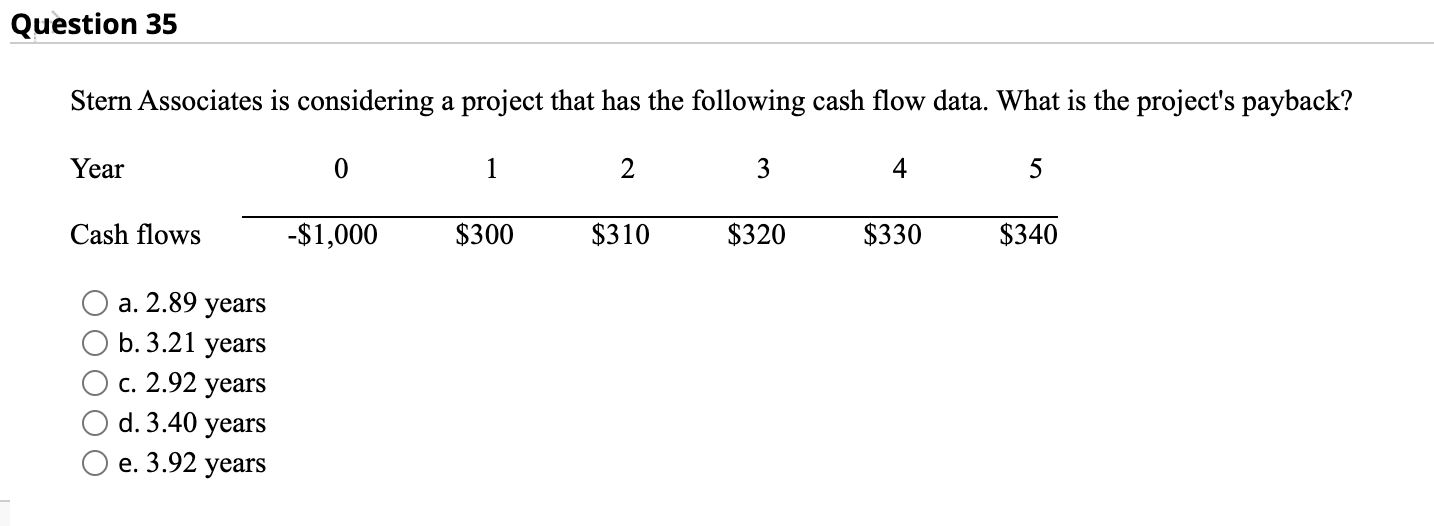

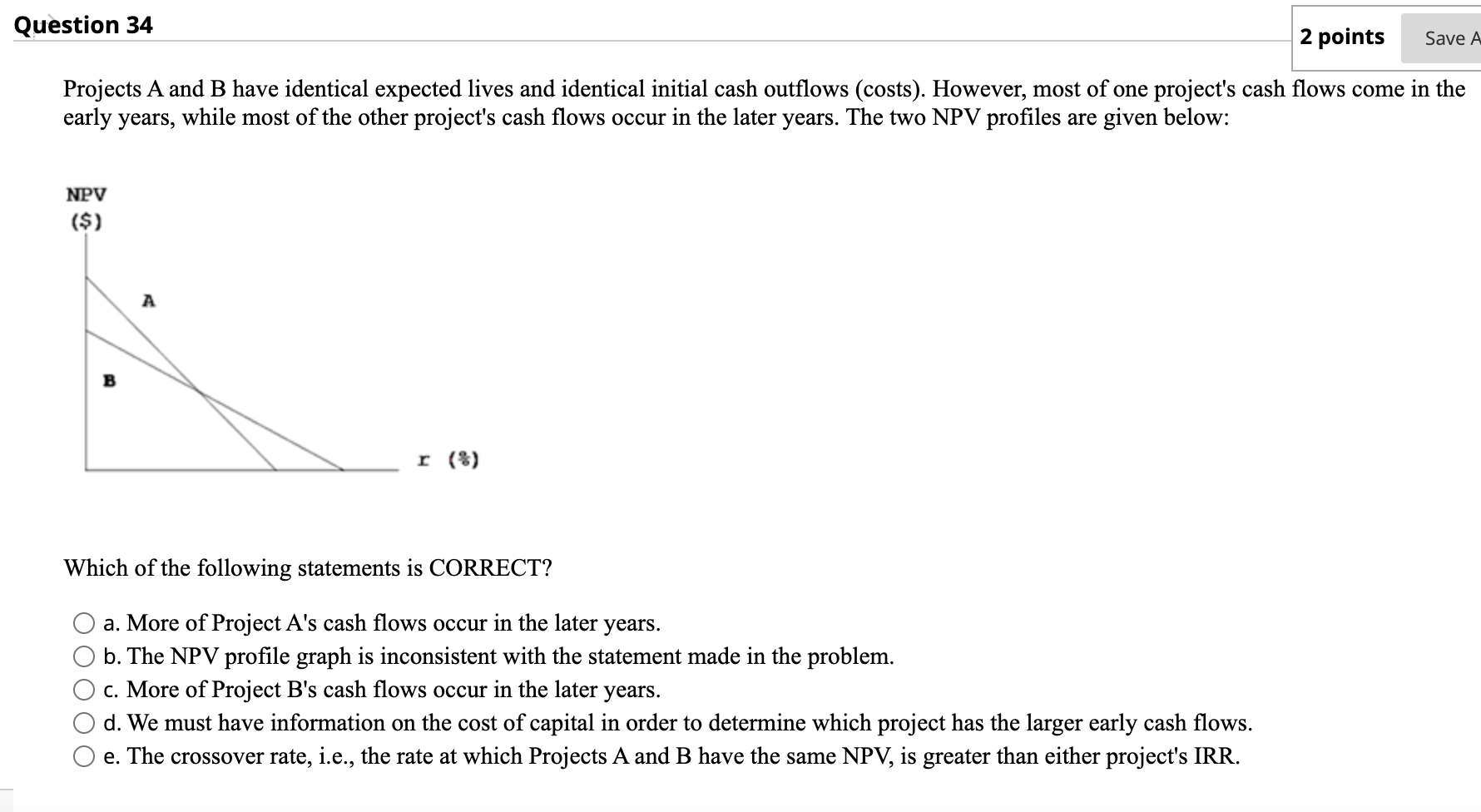

Question 36 2 points Fernando Designs is considering a project that has the following cash flow and WACC data. What is the project's discounted payback? WACC: 10.00% Year 0 1 2 3 Cash flows -$750 $500 $500 $500 a. 1.72 years b. 1.53 years c. 1.56 years d. 1.61 years e. 1.29 years Question 35 Stern Associates is considering a project that has the following cash flow data. What is the project's payback? Year 0 1 2 3 4 5 Cash flows -$1,000 $300 $310 $320 $330 $340 a. 2.89 years O b.3.21 years c. 2.92 years d. 3.40 years e. 3.92 years Question 34 2 points Save A Projects A and B have identical expected lives and identical initial cash outflows (costs). However, most of one project's cash flows come in the early years, while most of the other project's cash flows occur in the later years. The two NPV profiles are given below: NPV ($) A B r (8) Which of the following statements is CORRECT? a. More of Project A's cash flows occur in the later years. b. The NPV profile graph is inconsistent with the statement made in the problem. c. More of Project B's cash flows occur in the later years. d. We must have information on the cost of capital in order to determine which project has the larger early cash flows. e. The crossover rate, i.e., the rate at which Projects A and B have the same NPV, is greater than either project's IRR. Question 36 2 points Fernando Designs is considering a project that has the following cash flow and WACC data. What is the project's discounted payback? WACC: 10.00% Year 0 1 2 3 Cash flows -$750 $500 $500 $500 a. 1.72 years b. 1.53 years c. 1.56 years d. 1.61 years e. 1.29 years Question 35 Stern Associates is considering a project that has the following cash flow data. What is the project's payback? Year 0 1 2 3 4 5 Cash flows -$1,000 $300 $310 $320 $330 $340 a. 2.89 years O b.3.21 years c. 2.92 years d. 3.40 years e. 3.92 years Question 34 2 points Save A Projects A and B have identical expected lives and identical initial cash outflows (costs). However, most of one project's cash flows come in the early years, while most of the other project's cash flows occur in the later years. The two NPV profiles are given below: NPV ($) A B r (8) Which of the following statements is CORRECT? a. More of Project A's cash flows occur in the later years. b. The NPV profile graph is inconsistent with the statement made in the problem. c. More of Project B's cash flows occur in the later years. d. We must have information on the cost of capital in order to determine which project has the larger early cash flows. e. The crossover rate, i.e., the rate at which Projects A and B have the same NPV, is greater than either project's IRR

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts