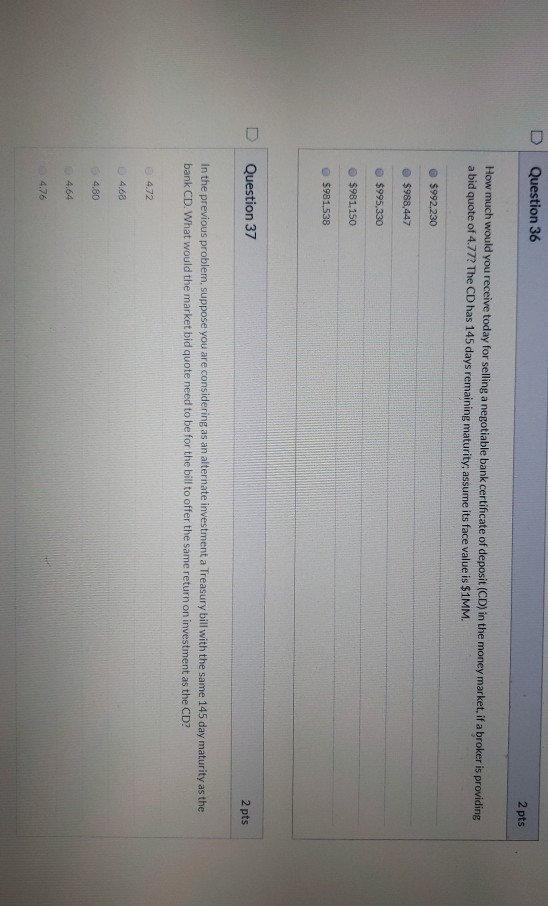

Question: Question 36 2 pts How much would you receive today for selling a negotiable bank certificate of deposit (CD) in the money market, if a

Question 36 2 pts How much would you receive today for selling a negotiable bank certificate of deposit (CD) in the money market, if a broker is providing a bid quote of 4.77? The CD has 145 days remaining maturity, assume its face value is $1MM. $992.230 $988,447 $995,330 $981,150 $981,538 O Question 37 2 pts In the previous problem, suppose you are considering as an alternate investment a Treasury bill with the same 145 day maturity as the bank CD. What would the market bid quote need to be for the bill to offer the same return on investment as the CD? 4.72 4.68 4.80 4.64 4.76

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock