Question: Question 36 3 pts a a A company is considering investing in a project that has a 10 year life. To pursue the project, the

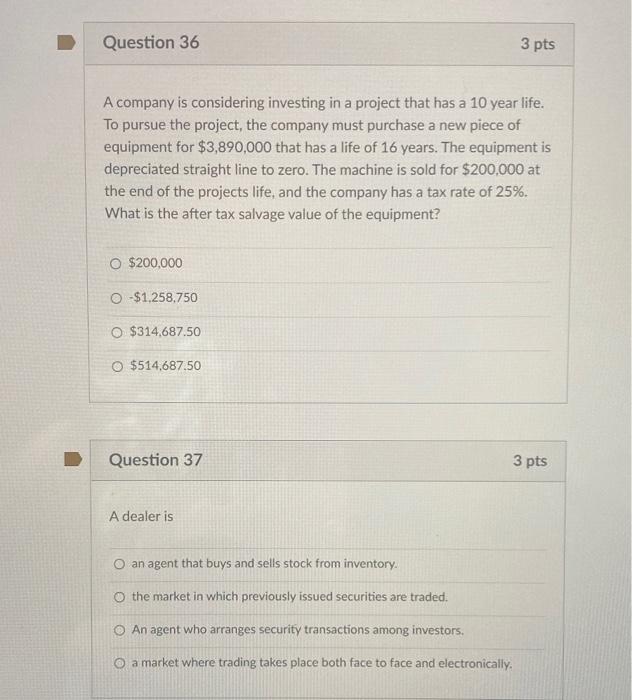

Question 36 3 pts a a A company is considering investing in a project that has a 10 year life. To pursue the project, the company must purchase a new piece of equipment for $3,890,000 that has a life of 16 years. The equipment is depreciated straight line to zero. The machine is sold for $200,000 at the end of the projects life, and the company has a tax rate of 25%. What is the after tax salvage value of the equipment? O $200,000 O -$1,258,750 O $314,687.50 O $514,687.50 Question 37 3 pts A dealer is an agent that buys and sells stock from inventory. O the market in which previously issued securities are traded. An agent who arranges security transactions among investors. O a market where trading takes place both face to face and electronically

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts