Question: QUESTION 36 Dirk is considering purchasing a 6-year bond that is selling for $1,150. What is the YTM for this bond if it has a

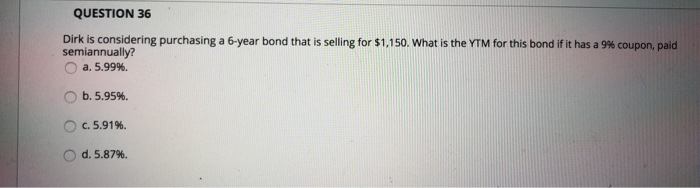

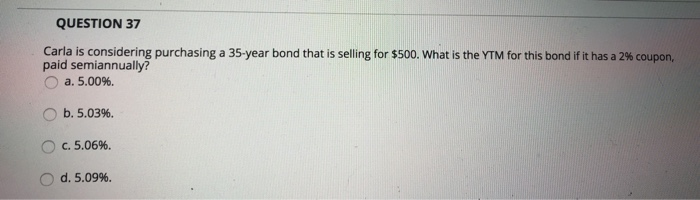

QUESTION 36 Dirk is considering purchasing a 6-year bond that is selling for $1,150. What is the YTM for this bond if it has a 9% coupon, paid semiannually? a. 5.99%. b. 5.95%, c. 5.91%. d. 5.87%. QUESTION 37 Carla is considering purchasing a 35-year bond that is selling for $500. What is the YTM for this bond if it has a 2 % coupon, paid semiannually? a. 5.00%. b. 5.03%. c. 5.06 %. O d. 5.09%

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts