Question: Question 37 (1 point) Fred does not have a retirement plan at work. Suppose he has $6,000 in cash to invest in a traditional IRA

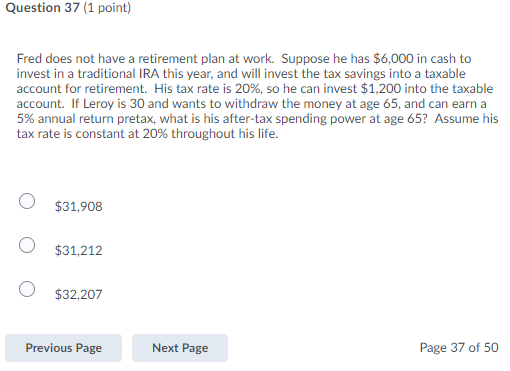

Question 37 (1 point) Fred does not have a retirement plan at work. Suppose he has $6,000 in cash to invest in a traditional IRA this year, and will invest the tax savings into a taxable account for retirement. His tax rate is 20%, so he can invest $1,200 into the taxable account. If Leroy is 30 and wants to withdraw the money at age 65, and can earn a 5% annual return pretax, what is his after-tax spending power at age 65? Assume his tax rate is constant at 20% throughout his life. O $31,908 $31,212 $32,207 Previous Page Previous Page Next Page Next Page Page 37 of 50 Question 37 (1 point) Fred does not have a retirement plan at work. Suppose he has $6,000 in cash to invest in a traditional IRA this year, and will invest the tax savings into a taxable account for retirement. His tax rate is 20%, so he can invest $1,200 into the taxable account. If Leroy is 30 and wants to withdraw the money at age 65, and can earn a 5% annual return pretax, what is his after-tax spending power at age 65? Assume his tax rate is constant at 20% throughout his life. O $31,908 $31,212 $32,207 Previous Page Previous Page Next Page Next Page Page 37 of 50

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts