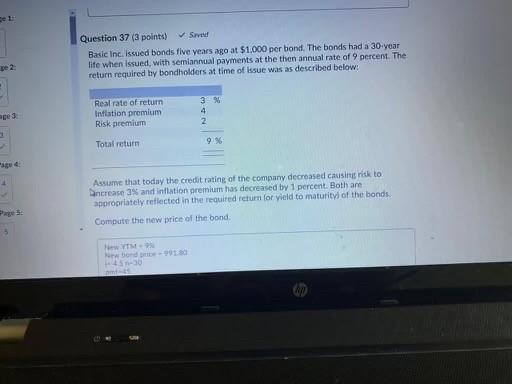

Question: Question 37 (3 points) Surved Basic Inc, issued bonds five years ago at $1.000 per bond. The bonds had a 30-year life when Issued, with

Question 37 (3 points) Surved Basic Inc, issued bonds five years ago at $1.000 per bond. The bonds had a 30-year life when Issued, with semiannual payments at the then annual rate of 9 percent. The return required by bondholders at time of issue was as described below: pe 3 Real rate of return Inflation premium Risk premium 4 2 Total return Assume that today the credit rating of the company decreased causing risk to Dancreases and inflation premium has decreased by 1 percent. Both are appropriately reflected in the required return for vield to maturity of the bonds Compute the new price of the bond. 5

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts