Question: QUESTION 37 A 2-year zero coupon bond issued at par by the UK government when interest rate is 2.5% will have a duration (in years)

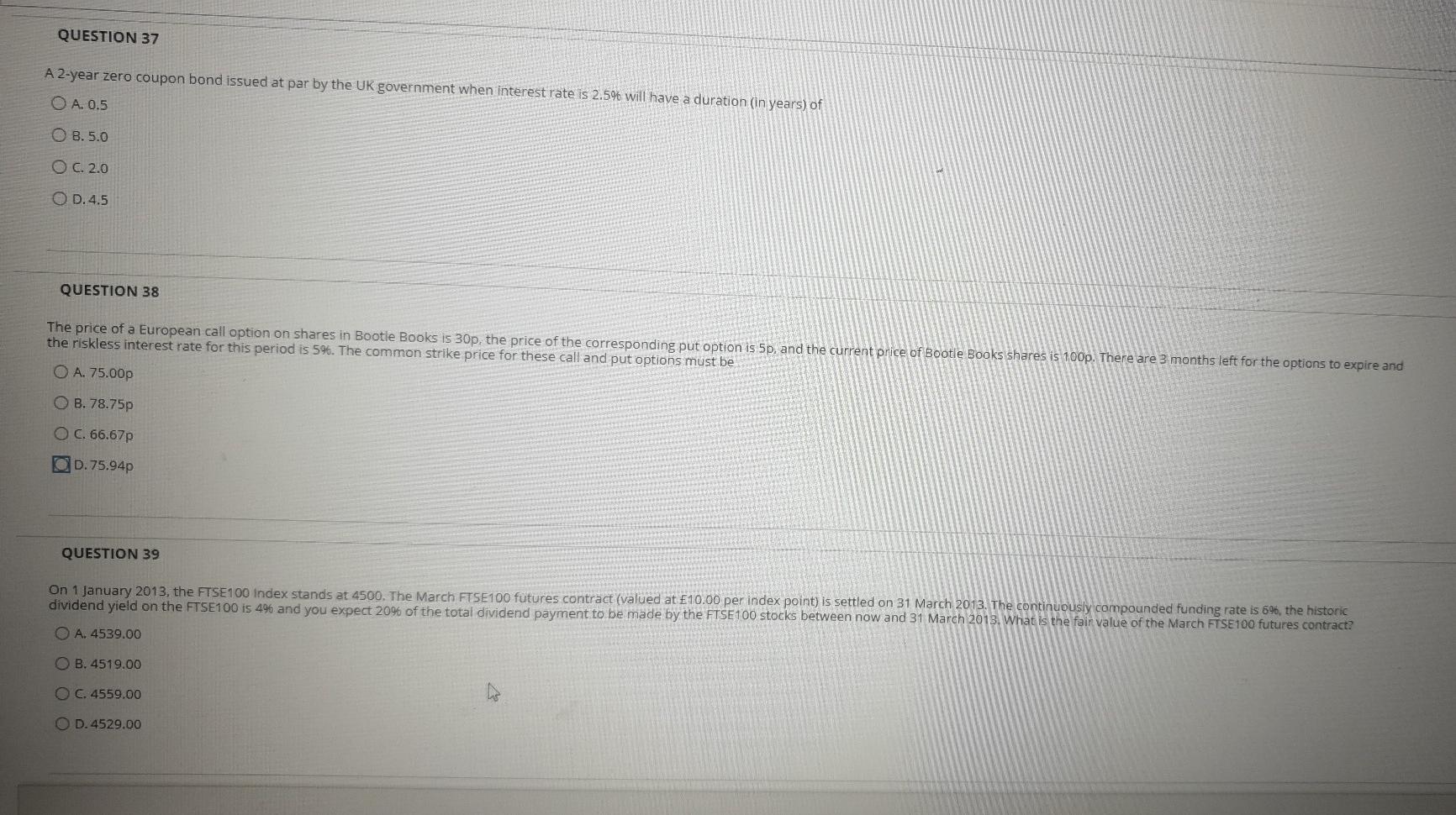

QUESTION 37 A 2-year zero coupon bond issued at par by the UK government when interest rate is 2.5% will have a duration (in years) of O A. 0.5 O B.5.0 O C. 2.0 O D.4.5 QUESTION 38 The price of a European call option on shares in Bootie Books is 30p, the price of the corresponding put option is 5p, and the current price of Bootle Books shares is 100p. There are 3 months left for the options to expire and the riskless interest rate for this period is 5%. The common strike price for these call and put options must be O A. 75.00p O B. 78.75p O C. 66.67p O 0.75.94p QUESTION 39 On 1 January 2013, the FTSE100 index stands at 4500. The March FTSE100 futures contract (valued at 10.00 per index point) is settled on 31 March 2013. The continuously compounded funding rate is 6%, the historic dividend yield on the FTSE100 is 49 and you expect 20% of the total dividend payment to be made by the FTSE 100 stocks between now and 31 March 2013. What is the fair value of the March FTSE 100 futures contract? O A. 4539.00 OB. 4519.00 O C. 4559.00 O D.4529.00

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts