Question: QUESTION 37 After learning the course, you divide your portfolio into three equal parts, with one part in Treasury bills, one part in a market

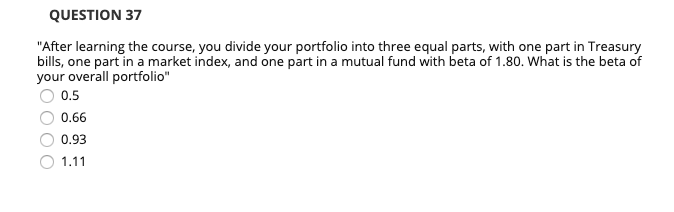

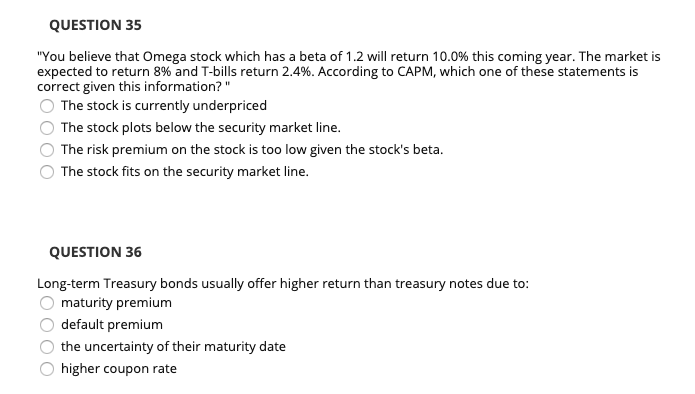

QUESTION 37 "After learning the course, you divide your portfolio into three equal parts, with one part in Treasury bills, one part in a market index, and one part in a mutual fund with beta of 1.80. What is the beta of your overall portfolio" 0.5 0.66 0.93 1.11 QUESTION 35 "You believe that Omega stock which has a beta of 1.2 will return 10.0% this coming year. The market is expected to return 8% and T-bills return 2.4%. According to CAPM, which one of these statements is correct given this information?" The stock is currently underpriced The stock plots below the security market line. The risk premium on the stock is too low given the stock's beta. The stock fits on the security market line. QUESTION 36 Long-term Treasury bonds usually offer higher return than treasury notes due to: maturity premium default premium the uncertainty of their maturity date higher coupon rate

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts