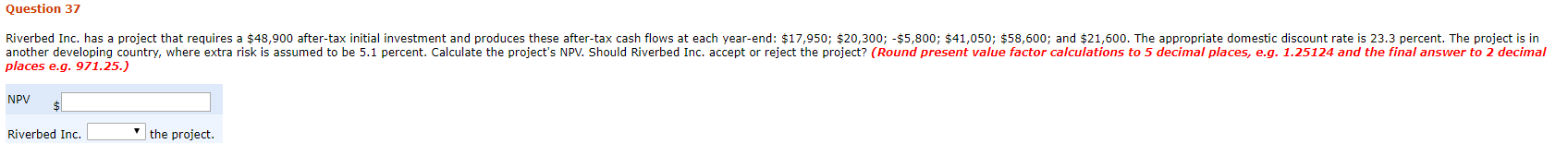

Question: Question 37 Riverbed Inc. has a project that requires a $48,900 after-tax initial investment and produces these after-tax cash flows at each year-end: $17,950; $20,300;

Question 37 Riverbed Inc. has a project that requires a $48,900 after-tax initial investment and produces these after-tax cash flows at each year-end: $17,950; $20,300; -$5,800; $41,050; $58,600; and $21,600. The appropriate domestic discount rate is 23.3 percent. The project is in another developing country, where extra risk is assumed to be 5.1 percent. Calculate the project's NPV. Should Riverbed Inc. accept or reject the project? (Round present value factor calculations to 5 decimal places, e.g. 1.25124 and the final answer to 2 decimal places e.g. 971.25.) NPV $ Riverbed Inc. the project

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts