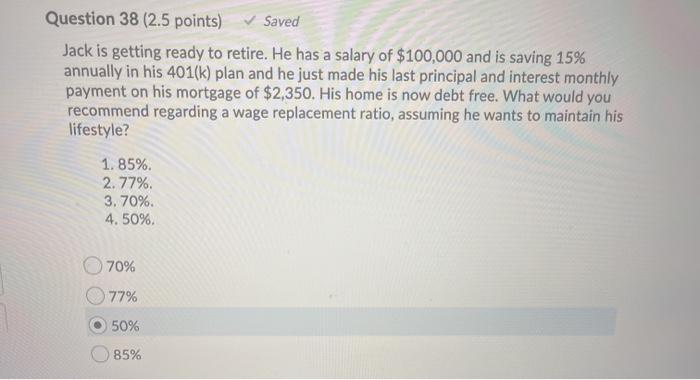

Question: Question 38 (2.5 points) Saved Jack is getting ready to retire. He has a salary of $100,000 and is saving 15% annually in his 401(k)

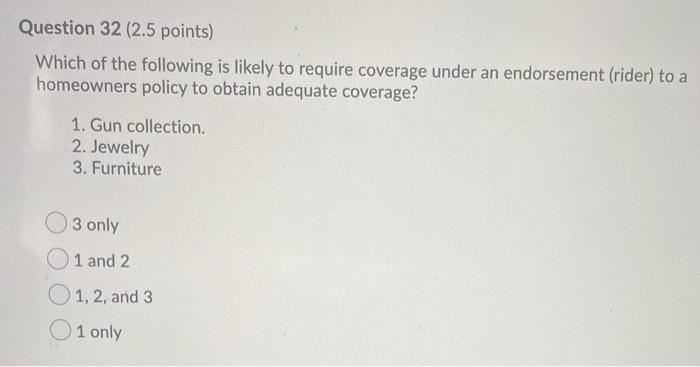

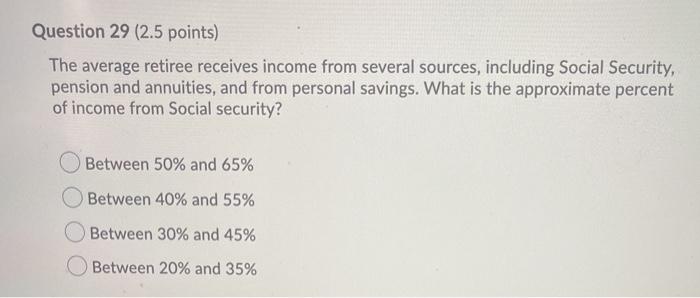

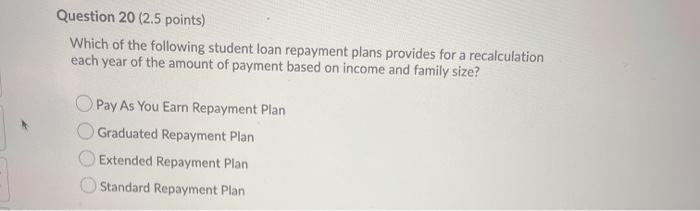

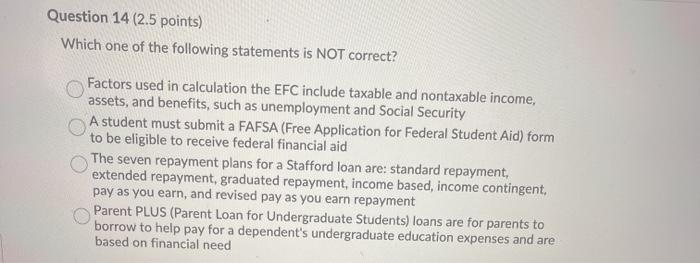

Question 38 (2.5 points) Saved Jack is getting ready to retire. He has a salary of $100,000 and is saving 15% annually in his 401(k) plan and he just made his last principal and interest monthly payment on his mortgage of $2,350. His home is now debt free. What would you recommend regarding a wage replacement ratio, assuming he wants to maintain his lifestyle? 1.85% 2.77% 3. 70%. 4.50%. 70% 77% 50% 85% Question 32 (2.5 points) Which of the following is likely to require coverage under an endorsement (rider) to a homeowners policy to obtain adequate coverage? 1. Gun collection. 2. Jewelry 3. Furniture 3 only 1 and 2 1, 2, and 3 O1 only Question 29 (2.5 points) The average retiree receives income from several sources, including Social Security, pension and annuities, and from personal savings. What is the approximate percent of income from Social security? Between 50% and 65% Between 40% and 55% Between 30% and 45% Between 20% and 35% Question 20 (2.5 points) Which of the following student loan repayment plans provides for a recalculation each year of the amount of payment based on income and family size? Pay As You Earn Repayment Plan Graduated Repayment Plan Extended Repayment Plan Standard Repayment Plan Question 14 (2.5 points) Which one of the following statements is NOT correct? Factors used in calculation the EFC include taxable and nontaxable income, assets, and benefits, such as unemployment and Social Security A student must submit a FAFSA (Free Application for Federal Student Aid) form to be eligible to receive federal financial aid The seven repayment plans for a Stafford loan are: standard repayment, extended repayment, graduated repayment, income based, income contingent pay as you earn, and revised pay as you earn repayment Parent PLUS (Parent Loan for Undergraduate Students) loans are for parents to borrow to help pay for a dependent's undergraduate education expenses and are based on financial need

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts