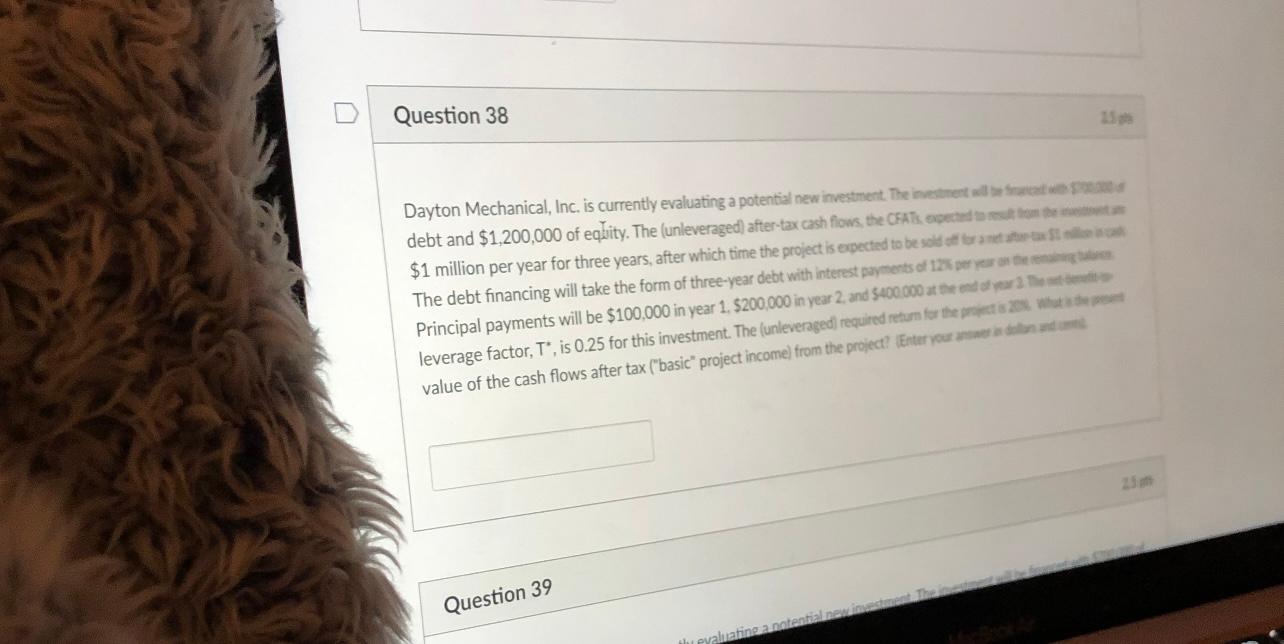

Question: Question 38 Dayton Mechanical, Inc. is currently evaluating a potential new investment. The investment debt and $1,200,000 of eqbity. The (unleveraged) after-tax cash flows, the

Question 38 Dayton Mechanical, Inc. is currently evaluating a potential new investment. The investment debt and $1,200,000 of eqbity. The (unleveraged) after-tax cash flows, the CSAK doo $1 million per year for three years, after which time the project is expected to be sodorant The debt financing will take the form of three-year debt with interest payments of 12% per the Principal payments will be $100,000 in year 1. $200,000 in year 2 and $400.000 at the end leverage factor, T, is 0.25 for this investment. The (unleveraged required return for the we value of the cash flows after tax ("basic" project income) from the project? (Enter your and Question 39 the evaluating amatentialing indah Question 38 Dayton Mechanical, Inc. is currently evaluating a potential new investment. The investment debt and $1,200,000 of eqbity. The (unleveraged) after-tax cash flows, the CSAK doo $1 million per year for three years, after which time the project is expected to be sodorant The debt financing will take the form of three-year debt with interest payments of 12% per the Principal payments will be $100,000 in year 1. $200,000 in year 2 and $400.000 at the end leverage factor, T, is 0.25 for this investment. The (unleveraged required return for the we value of the cash flows after tax ("basic" project income) from the project? (Enter your and Question 39 the evaluating amatentialing indah

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts