Question: question 3-8 please help! also explatain in detail for me. thank you so much for your time. At September 30 , the end of Beling

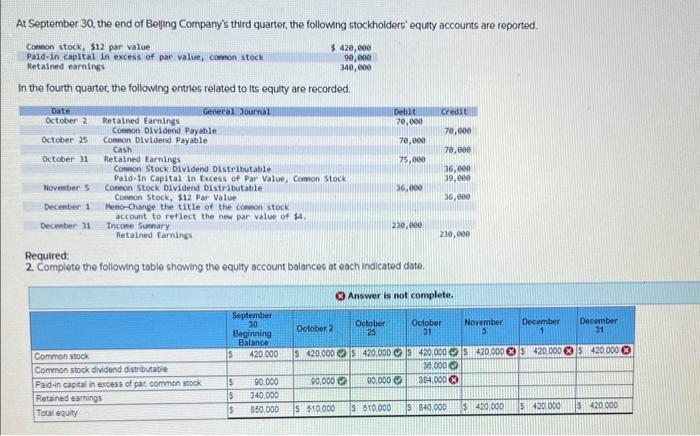

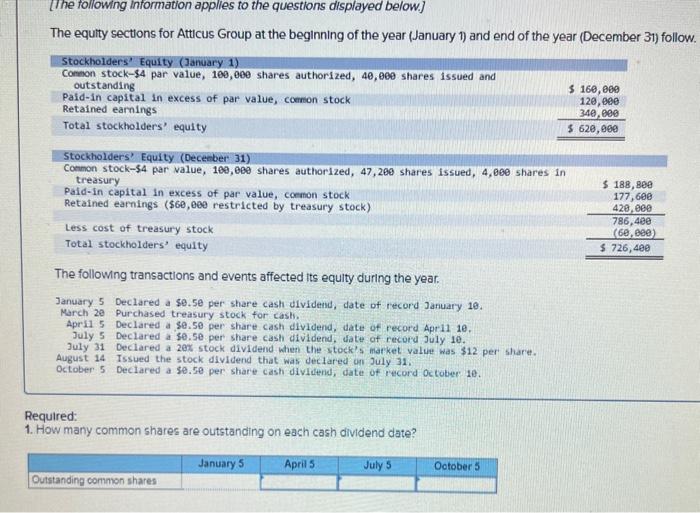

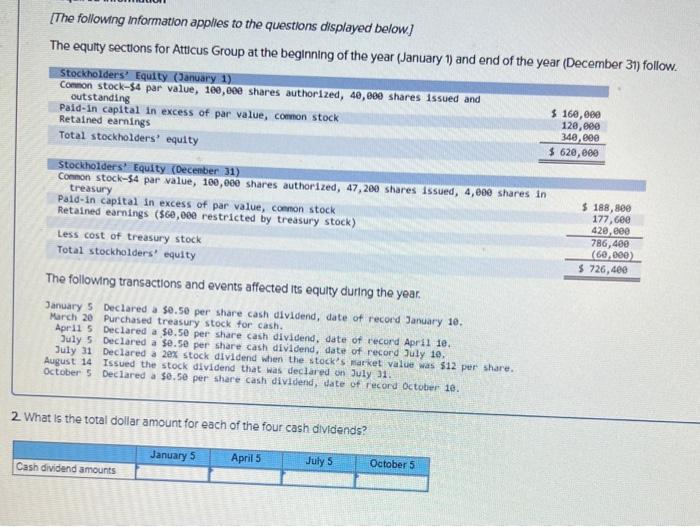

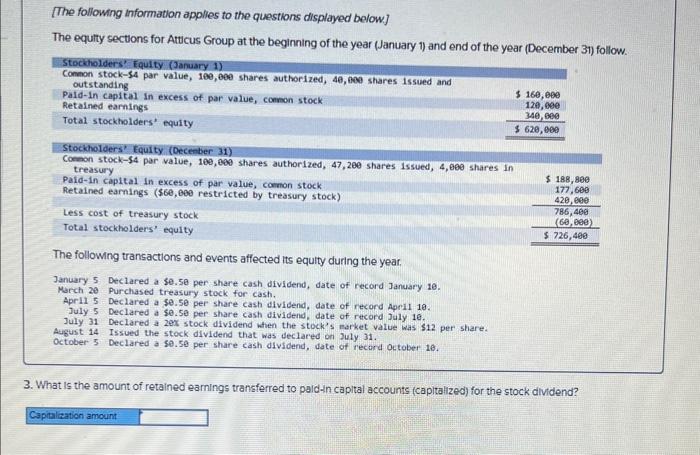

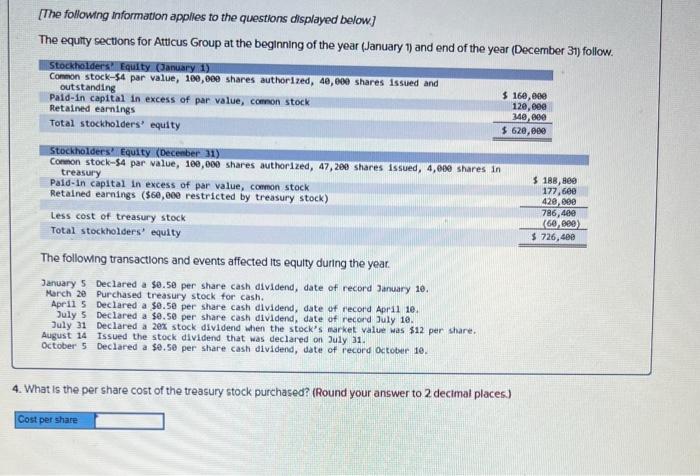

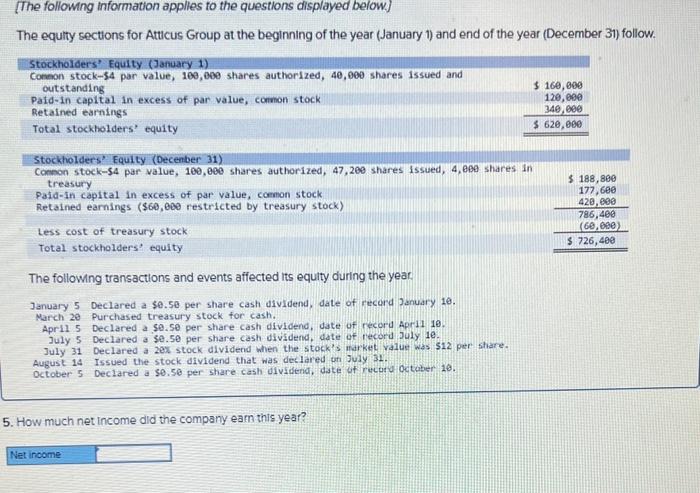

At September 30 , the end of Beling Company's third quarter, the followng stockholders' equity accounts are teported. Conoon stock, 512 par value Paid-in capital in excess of Retained earnings 5420,60099,600340,600 In the fourth quartec, the following entries related to its equity are recorded. Required: 2 Compiete the following table showing the equity account balances at oach indicated date. [The following information applies to the questions displayed below.] The equity sections for Atticus Group at the beginning of the year (January 1) and end of the year (December 31 ) follov The following transactions and events affected its equity during the year. January 5 Declared a 50.50 per share cash dividend, date of record January 10. March 20 Purchased treasury stock for casth. April 5 Declared a se.50 per share cash dividend, date of record Apri1 10. July 5 Declared a se. Se per share cash dividend, date of record July 10. July 31 Declared a 2ex stock dividend when the stock's market value was $12 per share. August 14 Issued the stock dividend that wak declared on July 31 . October 5 Declared a se.5e per share cash dividend, date of record october 10. Required: 1. How many common shares are outstanding on each cash dividend date? [The following information applies to the questions displayed below] The equity sections for Atticus Group at the beginning of the year (January 1) and end of the year (December 31 ) follow. we rourwing transactions and events affected its equity during the year. January 5 Declared a se.50 per share cash alvidend, date of record January 10. March 20 Purchased treasury stock for cash. Apri1 5 Declared a se.50 per share cash dividend, date of recond Apri1 10 , July 5 declared a se. Se per share cash dividend, date of record July 1e. July a1 Declared a 2ex stock alvidend when the stock's market value was $12 per share. August.14 Issued the stock dividend that was deciared on July 31 . October 5 Declared a se.5e per share cash dividend, date of record october 1e. 2. What is the total dollar amount for each of the four cash dividends? [The following information applies to the questions displayed below] The equity sections for Atticus Group at the beginning of the year (January 1) and end of the year (December 31) follow. The following transactions and events affected its equity during the year. January 5 Declared a se.5e per share cash dividend, date of record January 10. March 20 Purchased treasury stock for cash. Apri1 5 Declared a se.50 per share cash dividend, date of record April 10. July 5 Declared a se. Se per share cash dividend, date of racord July 16. July 31 Declared a 2ex stock dividend when the stock's parket value was \$12 per share. August 14 Issued the stock dividend that was declared on Suly 31. October 5 Declared a se.5e per share cash dividend, date of record october 16. 3. What is the amount of retained earnings transferred to paid-n capital accounts (capitalized) for the stock dividend? [The following information applies to the questions displayed below] The equity sections for Atticus Group at the beginning of the year (January 1) and end of the year (December 31) follow. Stockholders" Equity (January i) Comon stock-\$4 par value, 100,600 shares author1zed, 40,609 shares issued and outstanding The following transactions and events affected its equity during the year: January 5 Declared a $0.50 per share cash alvidend, date of record January 10. March 20 Purchased treasury stock for cash. Ape11 5 Declared a 30.50 per share cash dividend, date of record April 10. July 5 Declared a se.5e per share cash dividend, date of record July 10. July 31 Declared a 2 ex stock dividend bhen the stock's markek value was $12 per share. August 14 Issued the stock dividend that was declared on July 31 . october 5 Declared a se.5e per share cash dividend, date of record october 10. 4. What is the per share cost of the treasury stock purchased? (Round your answer to 2 decimal places) [The followng information applies to the questions displayed below] The equity sectlons for Atticus Group at the beginning of the year (January 1) and end of the year (December 3 ) follow. The followng transactions and events affected its equity during the year. January 5 Declared a 50.50 per share cash dividend, date of record 2anuary 10. March 20 purchased treasury stock for cash. Apr11 5 Declared a se. Se per share cash dividend, date of record Apr11 10. July 5 Declared a Se.50 per share cash divdend, date of record July 1e. July 31 Declared a 2ex stock dividend when the stock's narket value ws $12 per stare. August 14 Issued the stock dividend that was deelared on July 31 . October 5 Declared a se.50 per share cash dividend, date of recurd octaber 18. 5. How much net income did the company earn this year

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts