Question: QUESTION 38 Star, a single individual, received the following items of income/benefits during the current year. $2,000 in food stamps from the state. $10,000 for

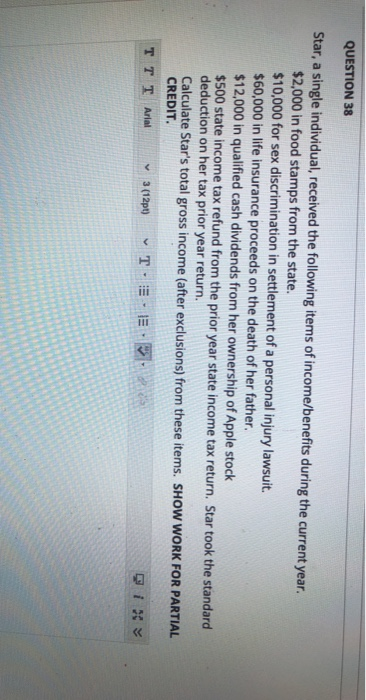

QUESTION 38 Star, a single individual, received the following items of income/benefits during the current year. $2,000 in food stamps from the state. $10,000 for sex discrimination in settlement of a personal injury lawsuit. $60,000 in life insurance proceeds on the death of her father. $12,000 in qualified cash dividends from her ownership of Apple stock $500 state income tax refund from the prior year state income tax return. Star took the standard deduction on her tax prior year return. Calculate Star's total gross income (after exclusions) from these items. SHOW WORK FOR PARTIAL CREDIT. TTT Arial T-E- E 3 (12pt)

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock