Question: Question 39 4 pts For the next two problems use the following information: Central Laundry & Cleaners is considering replacing an existing piece of machinery

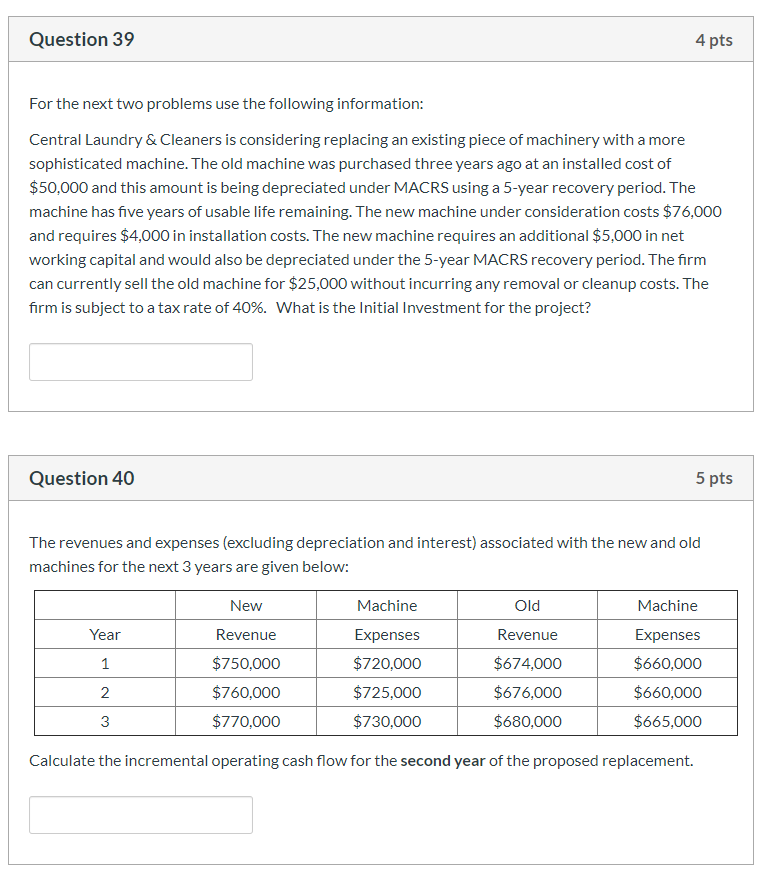

Question 39 4 pts For the next two problems use the following information: Central Laundry & Cleaners is considering replacing an existing piece of machinery with a more sophisticated machine. The old machine was purchased three years ago at an installed cost of $50,000 and this amount is being depreciated under MACRS using a 5-year recovery period. The machine has five years of usable life remaining. The new machine under consideration costs $76,000 and requires $4,000 in installation costs. The new machine requires an additional $5,000 in net working capital and would also be depreciated under the 5-year MACRS recovery period. The firm can currently sell the old machine for $25,000 without incurring any removal or cleanup costs. The firm is subject to a tax rate of 40%. What is the initial Investment for the project? Question 40 5 pts The revenues and expenses (excluding depreciation and interest) associated with the new and old machines for the next 3 years are given below: New Machine Machine Year Revenue Expenses $750,000 $760,000 $770,000 Old Revenue $674,000 $676,000 $680,000 $720,000 $725,000 $730,000 2 Expenses $660,000 $660,000 $665,000 3 Calculate the incremental operating cash flow for the second year of the proposed replacement

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts