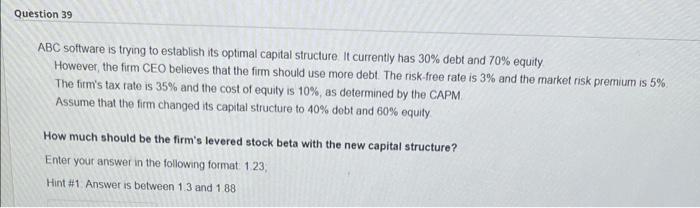

Question: Question 39 ABC software is trying to establish its optimal capital structure It currently has 30% debt and 70% equity However, the firm CEO believes

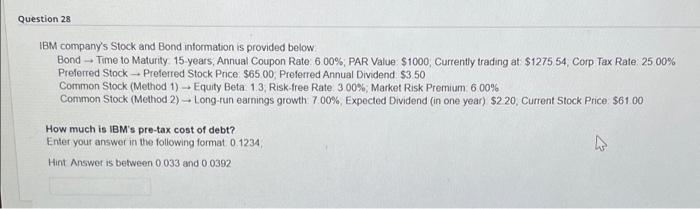

Question 39 ABC software is trying to establish its optimal capital structure It currently has 30% debt and 70% equity However, the firm CEO believes that the firm should use more debt. The risk free rate is 3% and the market risk premium is 5% The firm's tax rate is 35% and the cost of equity is 10%, as determined by the CAPM Assume that the firm changed its capital structure to 40% debt and 60% equity How much should be the firm's levered stock beta with the new capital structure? Enter your answer in the following format: 123 Hint #1 Answer is between 13 and 1 88 Question 28 IBM company's Stock and Bond information is provided below Bond - Time to Maturity 15 years, Annual Coupon Rate 600%, PAR Value $1000, Currently trading at $1275 54 Corp Tax Rate 2500% Preferred Stock - Proferred Stock Price $65 00, Preferred Annual Dividend $3.50 Common Stock (Method 1) - Equity Beta 1.3 Risk free Rate 300% Market Risk Premium 6.00% Common Stock (Method 2) - Long-run earnings growth 7.00%, Expected Dividend (in one year) $220, Current Stock Price $6100 How much is IBM's pre-tax cost of debt? Enter your answer in the following format 0 1234 Hint Answer is between 0033 and 00392

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts