Question: Question 3(CVP Analysis)(35 Marks) Development of the case( 5 marks on each scenario) Prem, who was a graduate student in engineering at the time, started

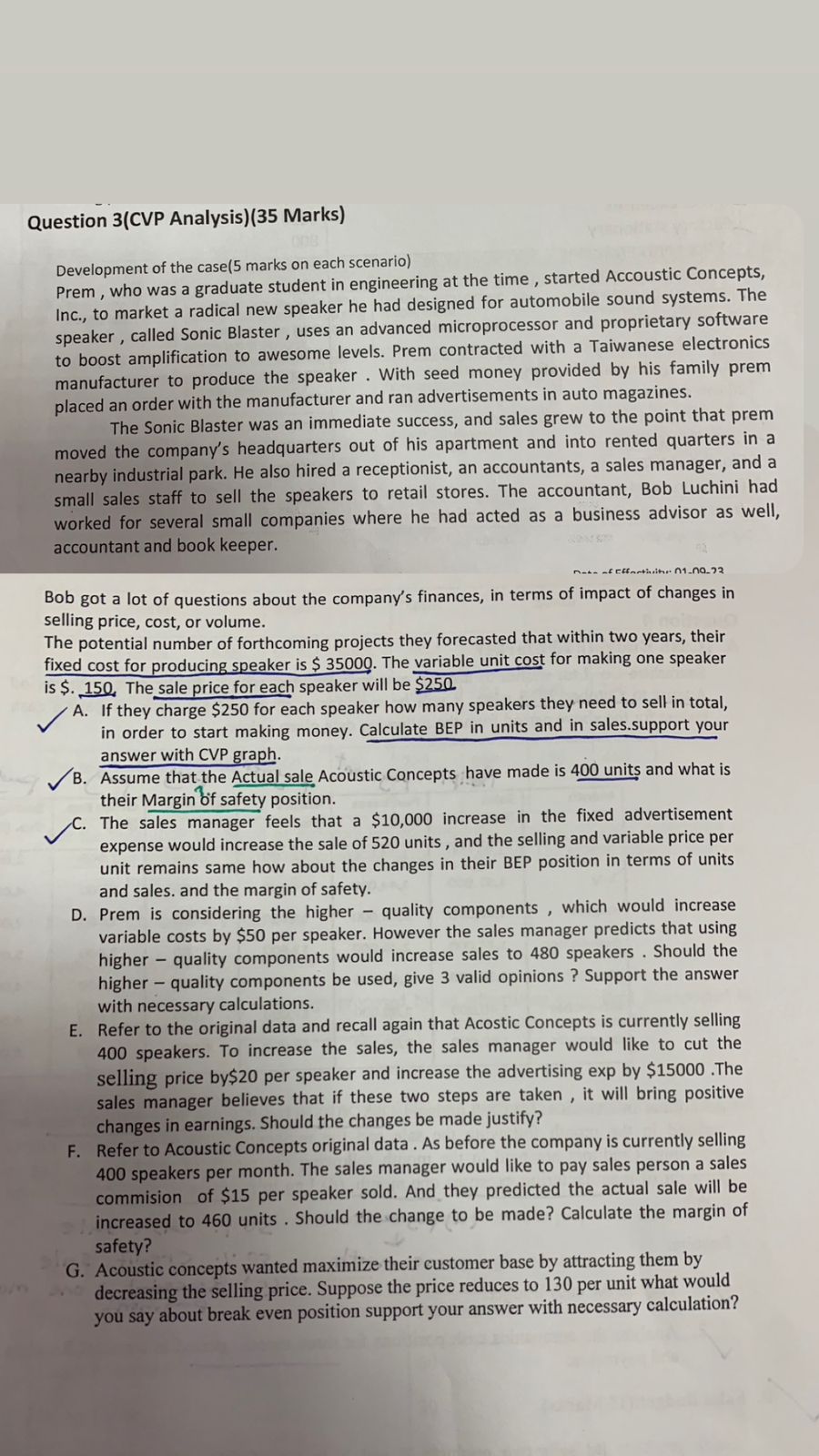

Question 3(CVP Analysis)(35 Marks) Development of the case( 5 marks on each scenario) Prem, who was a graduate student in engineering at the time, started Accoustic Concepts, Inc., to market a radical new speaker he had designed for automobile sound systems. The speaker, called Sonic Blaster, uses an advanced microprocessor and proprietary software to boost amplification to awesome levels. Prem contracted with a Taiwanese electronics manufacturer to produce the speaker. With seed money provided by his family prem placed an order with the manufacturer and ran advertisements in auto magazines. The Sonic Blaster was an immediate success, and sales grew to the point that prem moved the company's headquarters out of his apartment and into rented quarters in a nearby industrial park. He also hired a receptionist, an accountants, a sales manager, and a small sales staff to sell the speakers to retail stores. The accountant, Bob Luchini had worked for several small companies where he had acted as a business advisor as well, accountant and book keeper. Bob got a lot of questions about the company's finances, in terms of impact of changes in selling price, cost, or volume. The potential number of forthcoming projects they forecasted that within two years, their fixed cost for producing speaker is $35000. The variable unit cost for making one speaker is $.150. The sale price for each speaker will be $250 A. If they charge $250 for each speaker how many speakers they need to sell in total, in order to start making money. Calculate BEP in units and in sales.support your answer with CVP graph. B. Assume that the Actual sale Acoustic Concepts have made is 400 units and what is their Margin bf safety position. C. The sales manager feels that a $10,000 increase in the fixed advertisement expense would increase the sale of 520 units, and the selling and variable price per unit remains same how about the changes in their BEP position in terms of units and sales. and the margin of safety. D. Prem is considering the higher - quality components, which would increase variable costs by $50 per speaker. However the sales manager predicts that using higher - quality components would increase sales to 480 speakers. Should the higher - quality components be used, give 3 valid opinions ? Support the answer with necessary calculations. E. Refer to the original data and recall again that Acostic Concepts is currently selling 400 speakers. To increase the sales, the sales manager would like to cut the selling price by $20 per speaker and increase the advertising exp by $15000. The sales manager believes that if these two steps are taken, it will bring positive changes in earnings. Should the changes be made justify? F. Refer to Acoustic Concepts original data. As before the company is currently selling 400 speakers per month. The sales manager would like to pay sales person a sales commision of $15 per speaker sold. And they predicted the actual sale will be increased to 460 units. Should the change to be made? Calculate the margin of safety? G. Acoustic concepts wanted maximize their customer base by attracting them by decreasing the selling price. Suppose the price reduces to 130 per unit what would you say about break even position support your answer with necessary calculation

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts