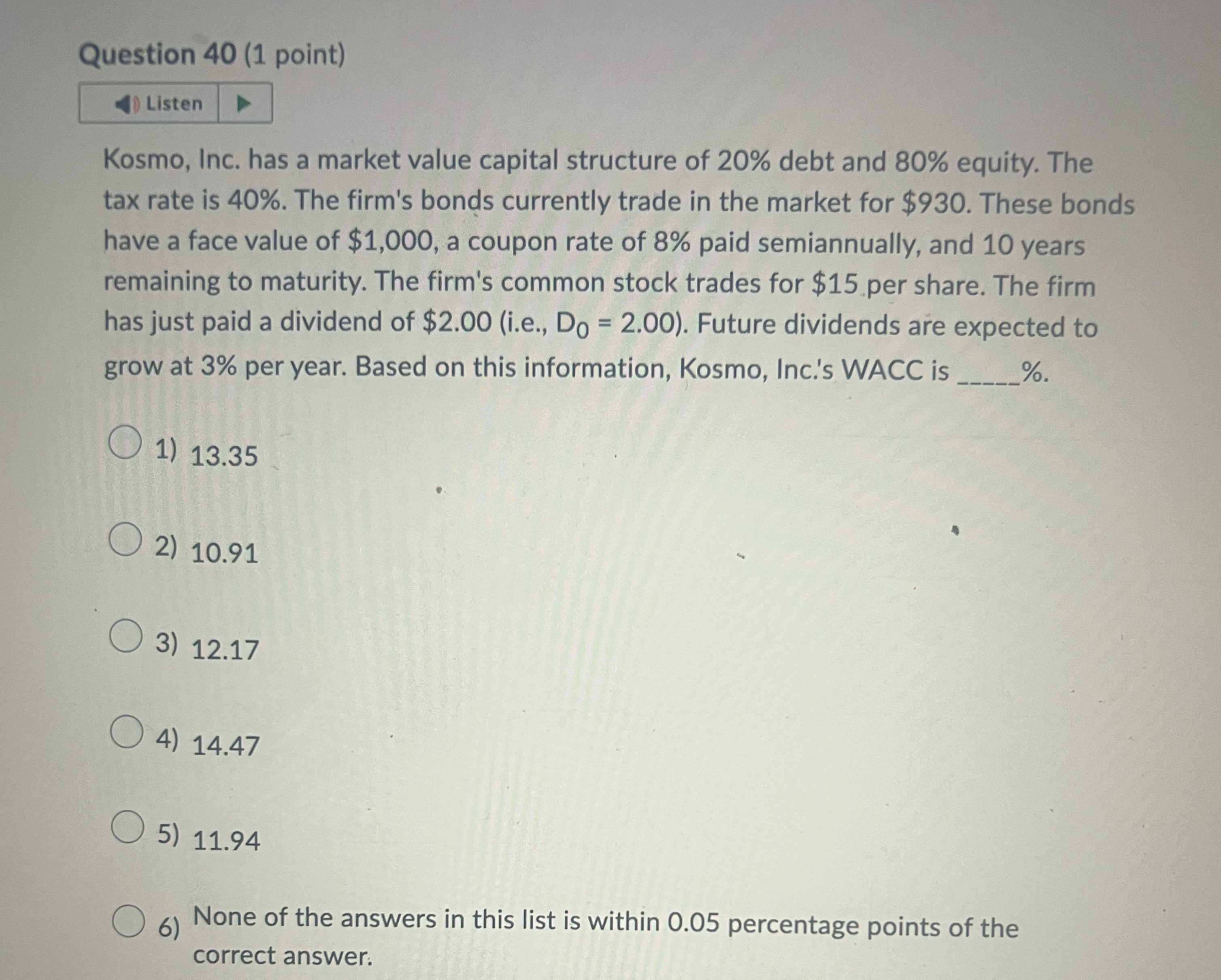

Question: Question 4 0 ( 1 point ) Kosmo, Inc. has a market value capital structure of 2 0 % debt and 8 0 % equity.

Question point

Kosmo, Inc. has a market value capital structure of debt and equity. The tax rate is The firm's bonds currently trade in the market for $ These bonds have a face value of $ a coupon rate of paid semiannually, and years remaining to maturity. The firm's common stock trades for $ per share. The firm has just paid a dividend of $ie Future dividends are expected to grow at per year. Based on this information, Kosmo, Inc.s WACC is

None of the answers in this list is within percentage points of the correct answer.

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock