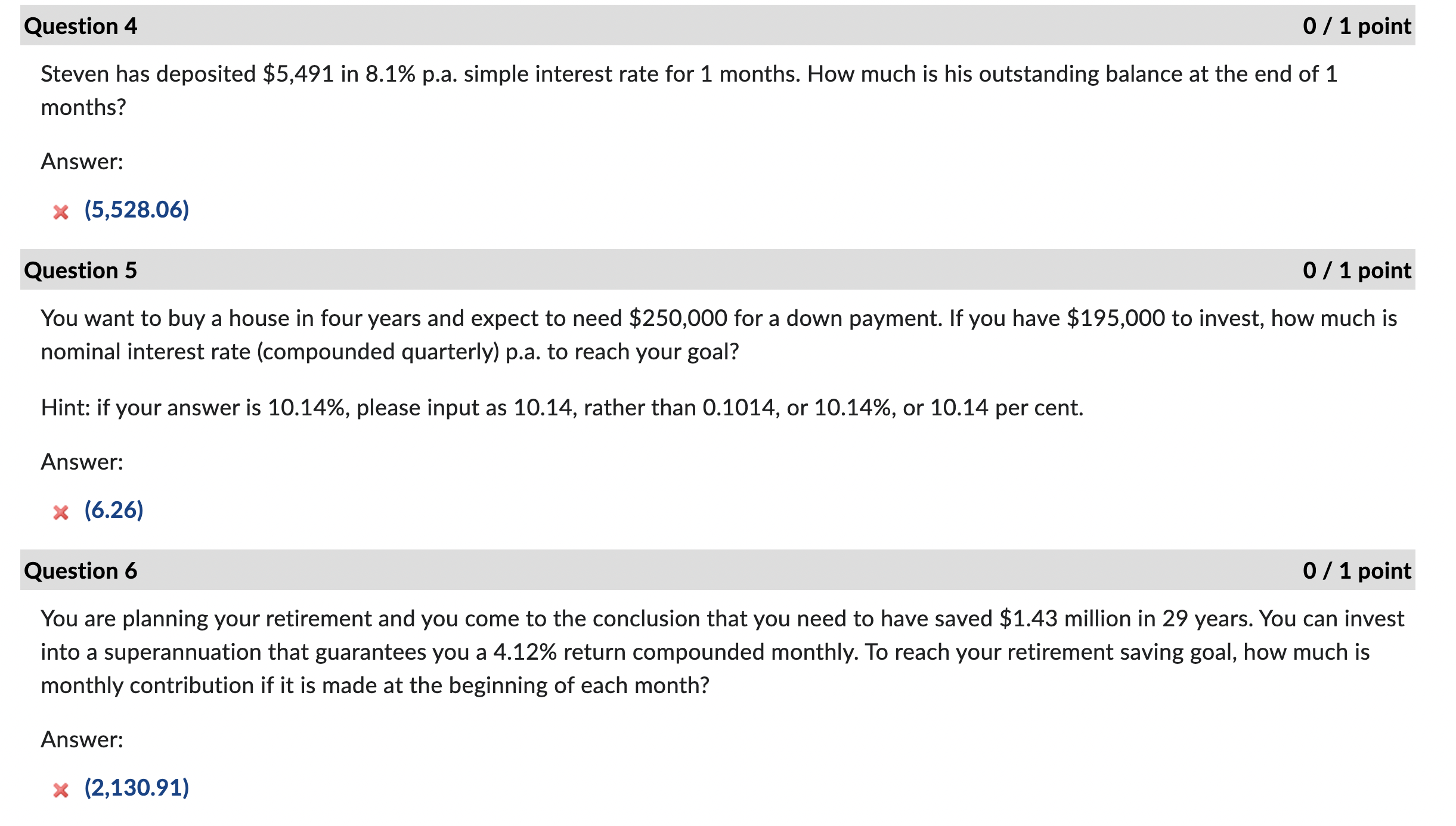

Question: Question 4 0 / 1 point Steven has deposited $5,491 in 8.1% p.a. simple interest rate for 1 months. How much is his outstanding balance

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock