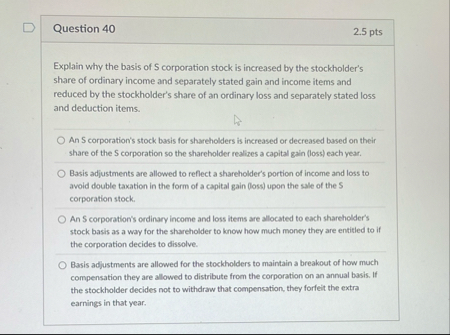

Question: Question 4 0 2 . 5 pts Explain why the basis of S corporation stock is increased by the stockholder's share of ordinary income and

Question

pts

Explain why the basis of S corporation stock is increased by the stockholder's share of ordinary income and separately stated gain and income items and reduced by the stockholder's share of an ordinary loss and separately stated loss and deduction items.

An S corporation's stock basis for shareholders is increased or decreased based on their share of the S corporation so the shareholder realizes a capital gain loss each year.

Basis adjustments are allowed to reflect a shareholder's portion of income and loss to avoid double taxation in the form of a capital gain loss upon the sale of the S corporation stock.

An $ corporation's ordinary income and loss items are allocated to each shareholder's stock basis as a way for the shareholder to know how much money they are entitied to if the corporation decides to dissolve.

Basis adjustments are allowed for the stockholders to maintain a breakout of how much compensation they are allowed to distribute from the corporation on an annual basis. If the stockholder decides not to withdraw that compensation, they forfeit the extra earnings in that year.

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock