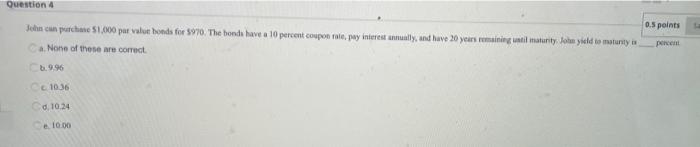

Question: Question 4 0.5 points John can purchase 51.000 par value honds for $970. The bonds have a 10 percent coupon rolepy interest mully, and have

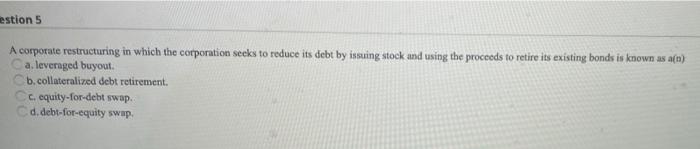

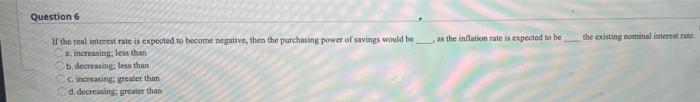

Question 4 0.5 points John can purchase 51.000 par value honds for $970. The bonds have a 10 percent coupon rolepy interest mully, and have 20 years remaining until maturity. Join yield to mounty is None of these are correct percent 1036 10.24 10.00 estion 5 A corporate restructuring in which the corporation seeks to reduce its debt by issuing stock and using the proceeds to retire its existing bonds is known as a(n) a. leveraged buyout b. collateralized debt retirement c. equity-for-debt swap Cd.debt-for-equity swap. Question 6 as the inflation rate is expected to be the existing nominal interest If the real interest rate is expected to become negative, then the purchasing power of savings would be a: Increasing less than D.decreasing less than Cincreasing greater than d. decreasing greater than

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts