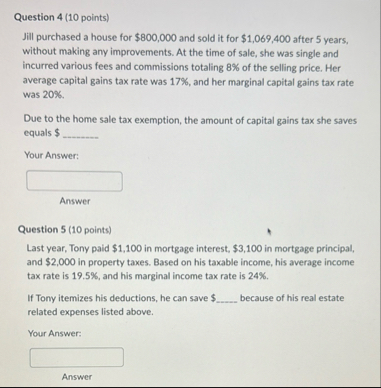

Question: Question 4 ( 1 0 points ) Jill purchased a house for $ 8 0 0 , 0 0 0 and sold it for $

Question points

Jill purchased a house for $ and sold it for $ after years, without making any improvements. At the time of sale, she was single and incurred various fees and commissions totaling of the selling price. Her average capital gains tax rate was and her marginal capital gains tax rate was

Due to the home sale tax exemption, the amount of capital gains tax she saves equals $

Your Answer:

Answer

Question points

Last year, Tony paid $ in mortgage interest, $ in mortgage principal, and $ in property taxes. Based on his taxable income, his average income tax rate is and his marginal income tax rate is

If Tony itemizes his deductions, he can save $ because of his real estate related expenses listed above.

Your Answer:

Answer

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock