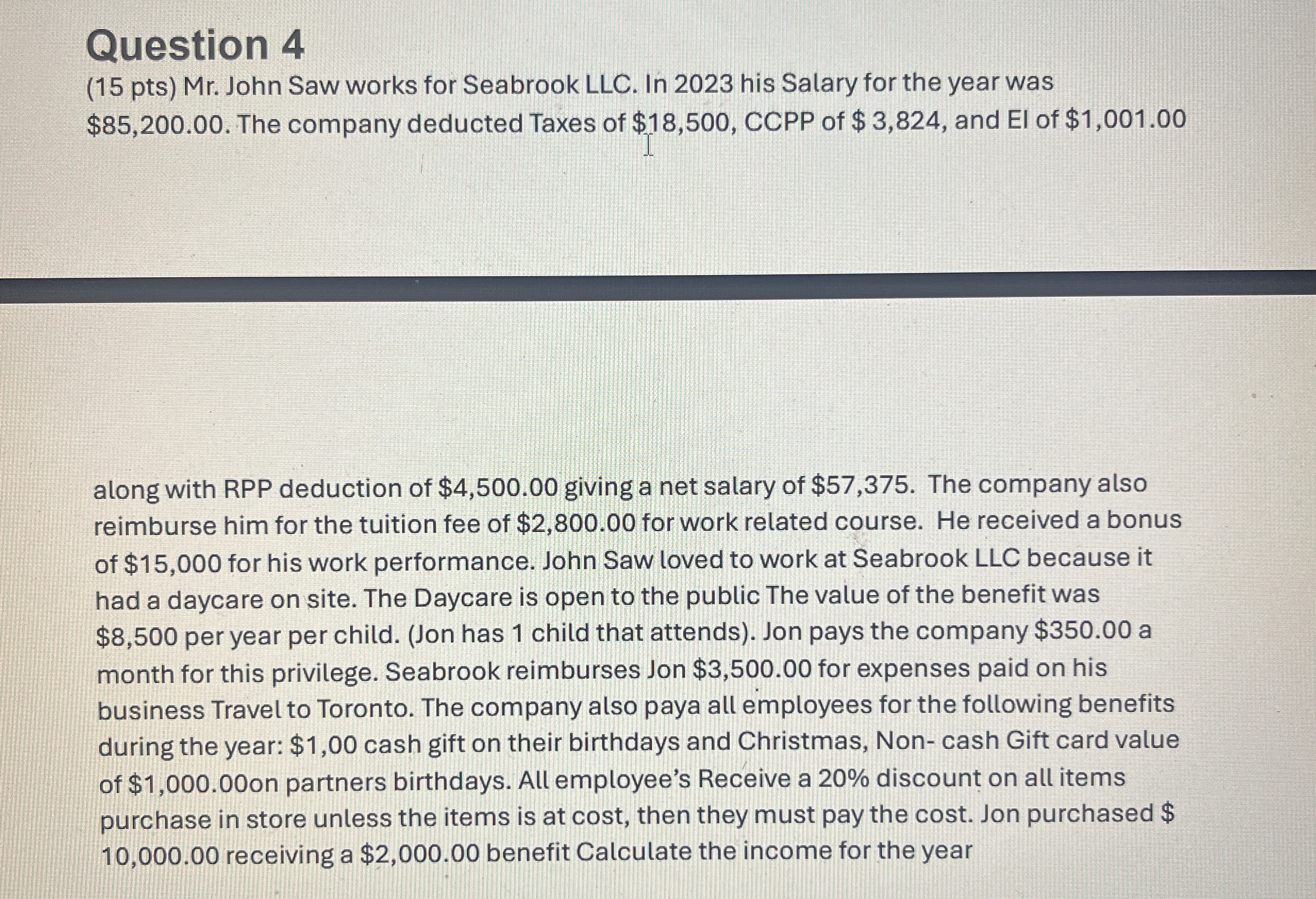

Question: Question 4 ( 1 5 pts ) Mr . John Saw works for Seabrook LLC . In 2 0 2 3 his Salary for the

Question

pts Mr John Saw works for Seabrook LLC In his Salary for the year was $ The company deducted Taxes of $ CCPP of $ and EI of $

along with RPP deduction of $ giving a net salary of $ The company also reimburse him for the tuition fee of $ for work related course. He received a bonus of $ for his work performance. John Saw loved to work at Seabrook LLC because it had a daycare on site. The Daycare is open to the public The value of the benefit was $ per year per child. Jon has child that attends Jon pays the company $ a month for this privilege. Seabrook reimburses Jon $ for expenses paid on his business Travel to Toronto. The company also paya all employees for the following benefits during the year: $ cash gift on their birthdays and Christmas, Noncash Gift card value of $ on partners birthdays. All employee's Receive a discount on all items purchase in store unless the items is at cost then they must pay the cost. Jon purchased $ receiving a $ benefit Calculate the income for the year

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock