Question: QUESTION 4 ( 1 7 marks ) Queen met Macg on a bus whilst travelling Europe. Both are young professionals. Queen is a South African

QUESTION

marks

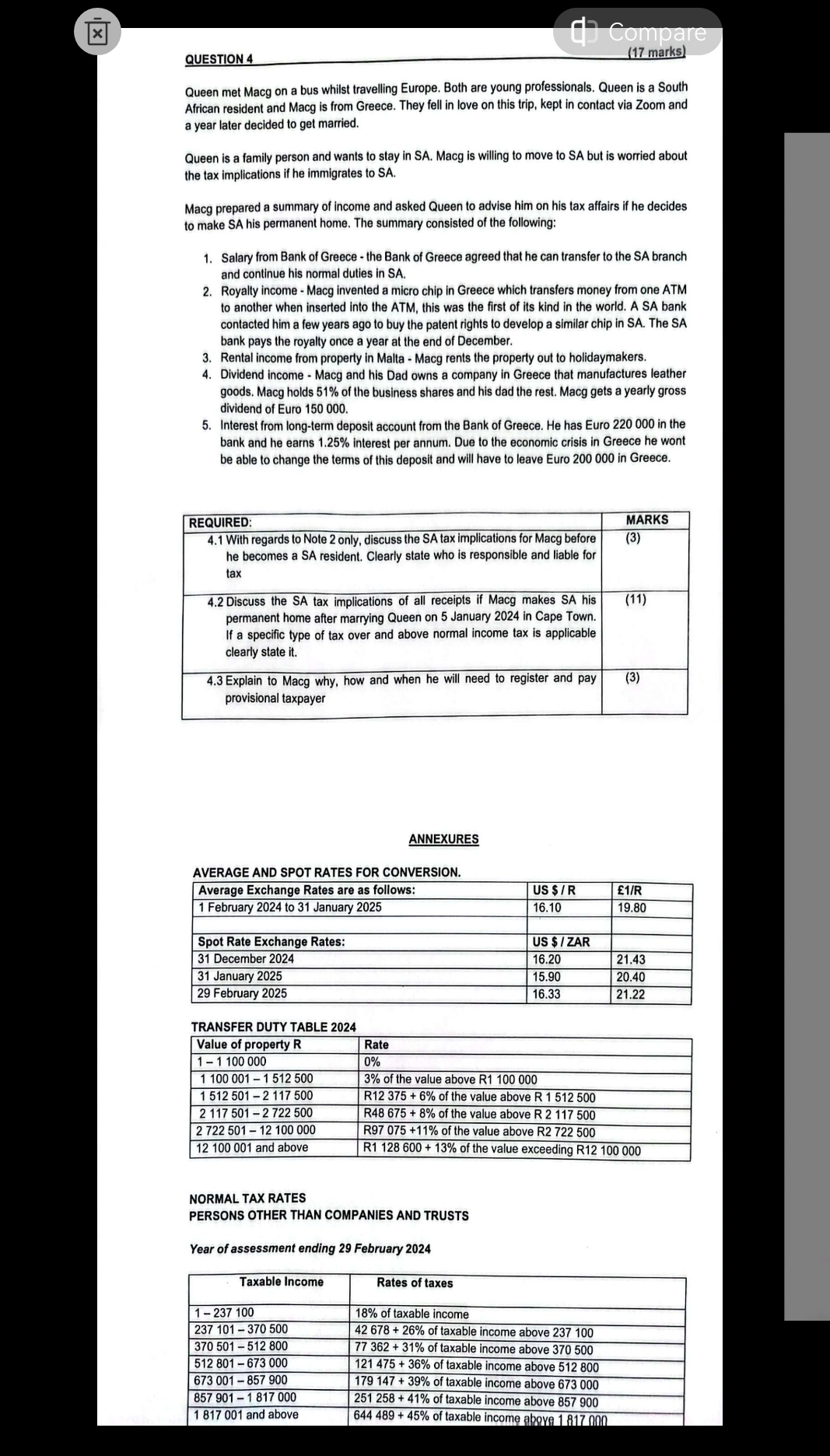

Queen met Macg on a bus whilst travelling Europe. Both are young professionals. Queen is a South African resident and Macg is from Greece. They fell in love on this trip, kept in contact via Zoom and a year later decided to get married.

Queen is a family person and wants to stay in SA Macg is willing to move to SA but is worried about the tax implications if he immigrates to SA

Macg prepared a summary of income and asked Queen to advise him on his tax affairs if he decides to make SA his permanent home. The summary consisted of the following:

Salary from Bank of Greece the Bank of Greece agreed that he can transfer to the SA branch and continue his normal duties in SA

Royalty income Macg invented a micro chip in Greece which transfers money from one ATM to another when inserted into the ATM, this was the first of its kind in the world. A SA bank contacted him a few years ago to buy the patent rights to develop a similar chip in SA The SA bank pays the royalty once a year at the end of December.

Rental income from property in Malta Macg rents the property out to holidaymakers.

Dividend income Macg and his Dad owns a company in Greece that manufactures leather goods. Macg holds of the business shares and his dad the rest. Macg gets a yearly gross dividend of Euro

Interest from longterm deposit account from the Bank of Greece. He has Euro in the bank and he earns interest per annum. Due to the economic crisis in Greece he wont be able to change the terms of this deposit and will have to leave Euro in Greece.

tableREQUIRED:MARKStable With regards to Note only, discuss the SA tax implications for Macg beforehe becomes a SA resident. Clearly state who is responsible and liable fortaxtable Discuss the SA tax implications of all receipts if Macg makes SA hispermanent home after marrying Queen on January in Cape Town.If a specific type of tax over and above normal income tax is applicableclearly state ittable Explain to Macg why, how and when he will need to register and payprovisional taxpayer

ANNEXURES

AVERAGE AND SPOT RATES FOR CONVERSION.

tableAverage Exchange Rates are as follows:,US

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock