Question: Question 4 (1 point) (CHAPTER 21) A firm can either lease or buy some equipment with its equity. The lease payments will be $9,000 a

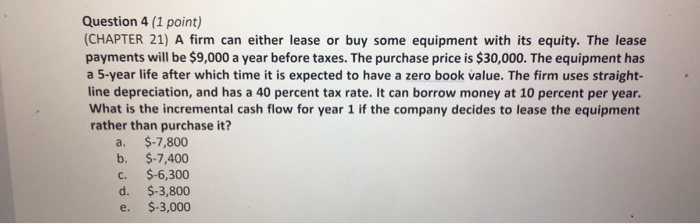

Question 4 (1 point) (CHAPTER 21) A firm can either lease or buy some equipment with its equity. The lease payments will be $9,000 a year before taxes. The purchase price is $30,000. The equipment has a 5-year life after which time it is expected to have a zero book value. The firm uses straight- line depreciation, and has a 40 percent tax rate. It can borrow money at 10 percent per year. What is the incremental cash flow for year 1 if the company decides to lease the equipment rather than purchase it? $-7,800 $-7,400 $-6,300 $-3,800 $-3,000 a. b. C. d. e

Step by Step Solution

There are 3 Steps involved in it

To solve this problem we need to calculate the incremental cash flow for Year 1 if the company decides to lease the equipment rather than purchase it ... View full answer

Get step-by-step solutions from verified subject matter experts