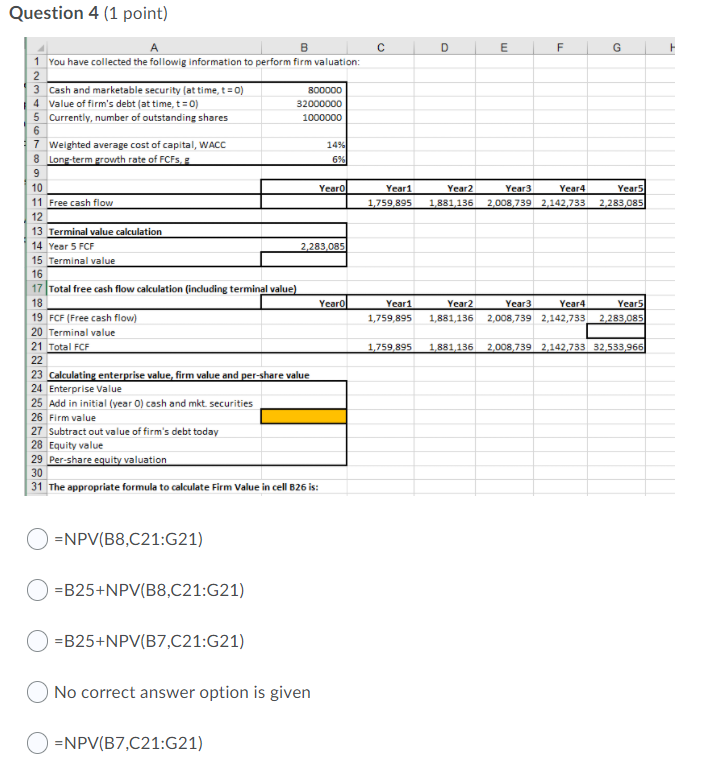

Question: Question 4 (1 point) D E F G Year 2 1.881 136 Year 3 Year 4 2.008,739 2.142.733 Year 5 2 283,085 1,759 895 B

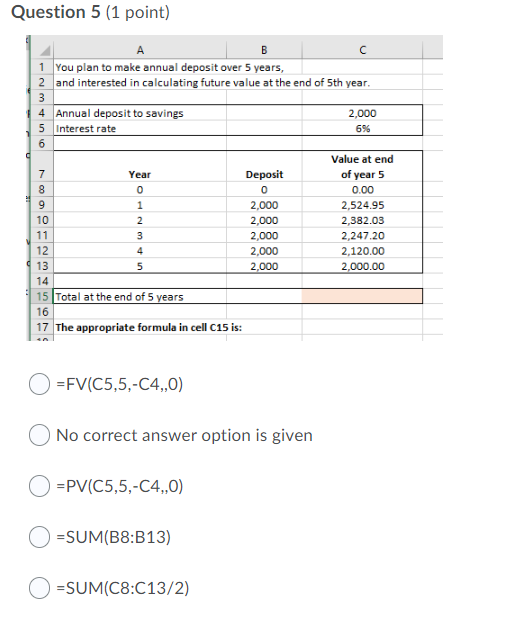

Question 4 (1 point) D E F G Year 2 1.881 136 Year 3 Year 4 2.008,739 2.142.733 Year 5 2 283,085 1,759 895 B 1 You have collected the followig information to perform firm valuation: 2 3 Cash and marketable security (at time, t = 0) 800000 4 Value of firm's debt (at time, t=0) 32000000 5 Currently, number of outstanding shares 1000000 6 7 Weighted average cost of capital, WACC 14% 8 Long-term growth rate of FCFS. E 6% 9 10 Year Year 1 11 Free cash flow 12 13 Terminal value calculation 14 Year 5 FCF 2.283.085 15 Terminal value 16 17 Total free cash flow calculation (including terminal value) 18 Year Year1 19 FCF (Free cash flow) 1,759,895 20 Terminal value 21 Total FCF 1,759,895 22 23 Calculating enterprise value, firm value and per-share value 24 Enterprise Value 25 Add in initial (year O) cash and mkt securities 26 Firm value 27 Subtract out value of firm's debt today 28 Equity value 29 Per-share equity valuation 30 31 The appropriate formula to calculate Firm Value in cell B26 is: Year2 1,881,136 Year3 Year 4 2,008,739 2,142,733 Years 2,283,085 1,881,136 2,008,739 2,142,733 32,533,966 =NPV(B8,C21:G21) =B25+NPV(B8,C21:G21) =B25+NPV(B7,C21:G21) No correct answer option is given =NPV(B7,C21:G21) Question 5 (1 point) 6% d B 1 You plan to make annual deposit over 5 years, 2 and interested in calculating future value at the end of 5th year. 3 4 Annual deposit to savings 2,000 5 Interest rate 6 Value at end 7 Year Deposit of year 5 8 0 0 0.00 9 1 2,000 2,524.95 10 2 2,000 2,382.03 11 3 2,000 2,247.20 12 4 2,000 2,120.00 13 5 2,000 2,000.00 14 15 Total at the end of 5 years 16 17 The appropriate formula in cell C15 is: 21 NO OMON =FV(C5,5,-C4,0) No correct answer option is given =PV(C5,5,-C4,,0) =SUM(B8:B13) =SUM(C8:C13/2)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts