Question: Question 4 (1 point) Listen X Inc. owns 70% of Y Inc. During 2020, X Inc. sold inventory to Y for $10,000. Half of

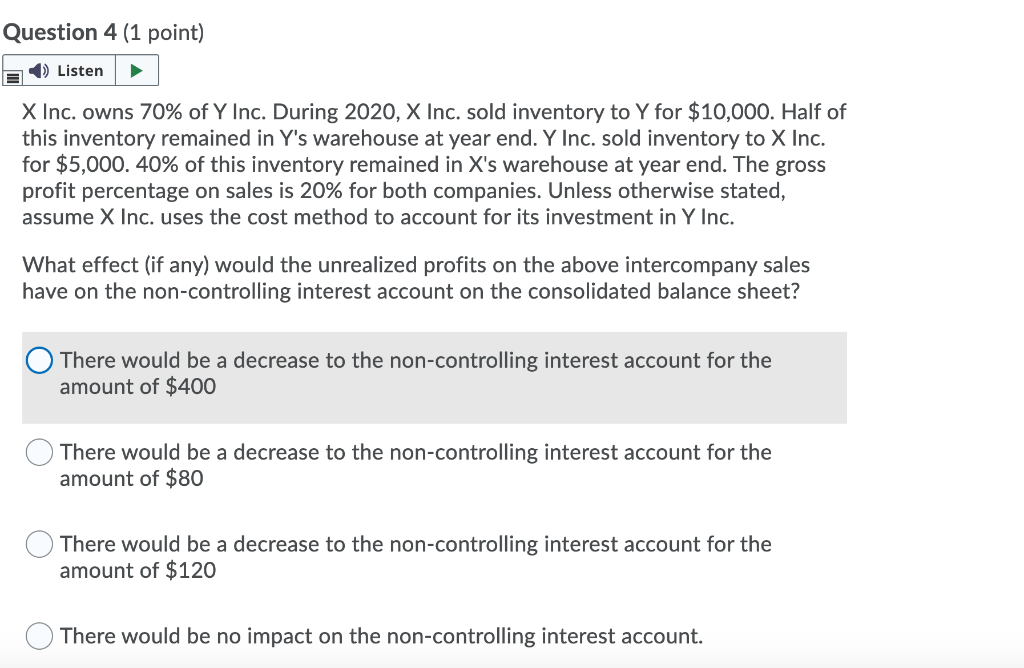

Question 4 (1 point) Listen X Inc. owns 70% of Y Inc. During 2020, X Inc. sold inventory to Y for $10,000. Half of this inventory remained in Y's warehouse at year end. Y Inc. sold inventory to X Inc. for $5,000. 40% of this inventory remained in X's warehouse at year end. The gross profit percentage on sales is 20% for both companies. Unless otherwise stated, assume X Inc. uses the cost method to account for its investment in Y Inc. What effect (if any) would the unrealized profits on the above intercompany sales have on the non-controlling interest account on the consolidated balance sheet? There would be a decrease to the non-controlling interest account for the amount of $400 There would be a decrease to the non-controlling interest account for the amount of $80 There would be a decrease to the non-controlling interest account for the amount of $120 There would be no impact on the non-controlling interest account.

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts