Question: Question 4 (1 point) Which cost flow comment is inaccurate conccerning the tawpayer's cost flow assumptions? The purpose of choosing a cost flow assumption for

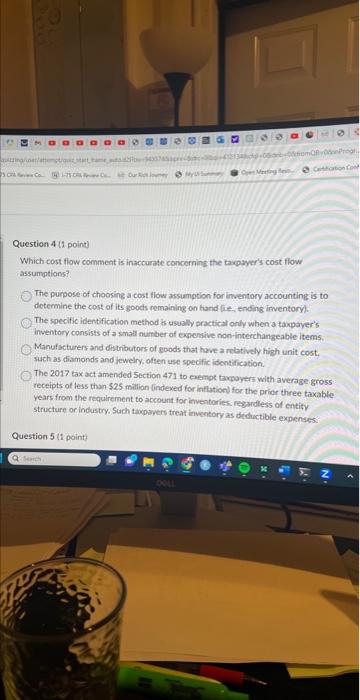

Question 4 (1 point) Which cost flow comment is inaccurate conccerning the tawpayer's cost flow assumptions? The purpose of choosing a cost flow assumption for imventory accounting is to determine the cost of its goods remaining on hand (ie, ending irventory). The specific identification method is usually practical only when a taxpaver's inventory consists of a small number of expensive non-interchangeable items. Manufacturers and distributors of eoods that hove a relatively high unit cost. such as diamonds and jewelry, offen use specific identification. The 2017 tax act amended Section 471 to enemot taxpayers with average gross receipts of less than \\( \\$ 25 \\) millian (indexed for inflation) for the prior three taxable years from the requirement to account for inventoriess regardless of entity structure or industry. Such tawpayers treat inventory as deductible expenses

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts