Question: Question 4 (1 point) Which is true regarding Flexble Spending Accounts Deferred amounts are subject to income tax or payroll tax Dependent care expenses are

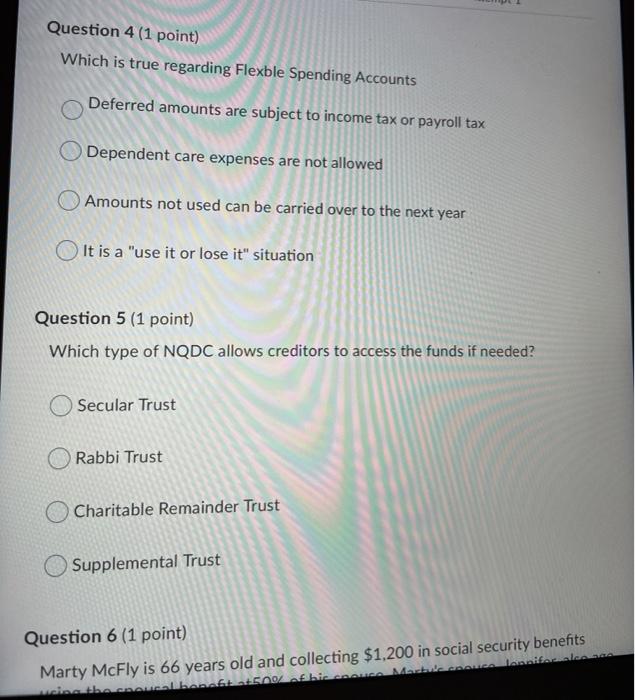

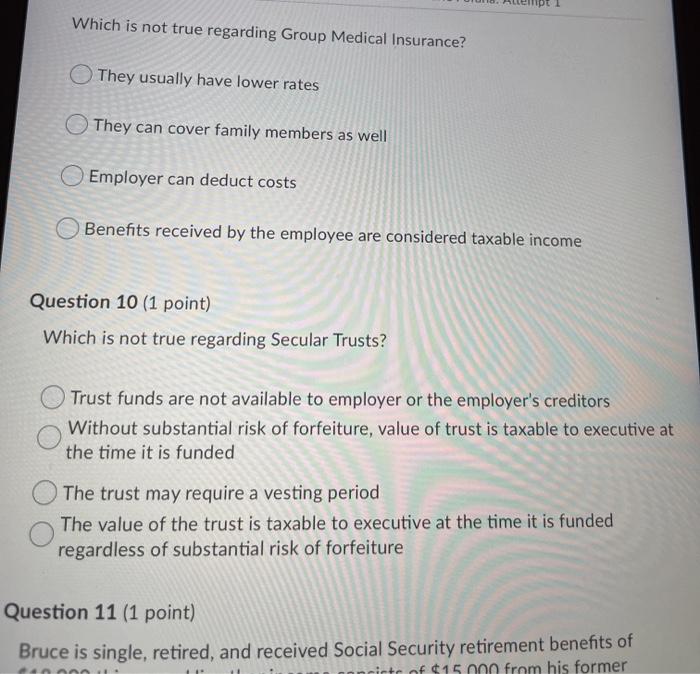

Question 4 (1 point) Which is true regarding Flexble Spending Accounts Deferred amounts are subject to income tax or payroll tax Dependent care expenses are not allowed Amounts not used can be carried over to the next year It is a "use it or lose it" situation Question 5 (1 point) Which type of NQDC allows creditors to access the funds if needed? Secular Trust Rabbi Trust Charitable Remainder Trust Supplemental Trust Question 6 (1 point) Marty McFly is 66 years old and collecting $1,200 in social security benefits in the clbonofs004 af bice Malossi Which is not true regarding Group Medical Insurance? They usually have lower rates They can cover family members as well Employer can deduct costs Benefits received by the employee are considered taxable income Question 10 (1 point) Which is not true regarding Secular Trusts? Trust funds are not available to employer or the employer's creditors Without substantial risk of forfeiture, value of trust is taxable to executive at the time it is funded The trust may require a vesting period The value of the trust is taxable to executive at the time it is funded regardless of substantial risk of forfeiture Question 11 (1 point) Bruce is single, retired, and received Social Security retirement benefits of of $15.00 from his former

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts