Question: Question 4 1 points Save Ansv You think that it is possible to outperform the CAPM and the Fama French 3 Factor model by forming

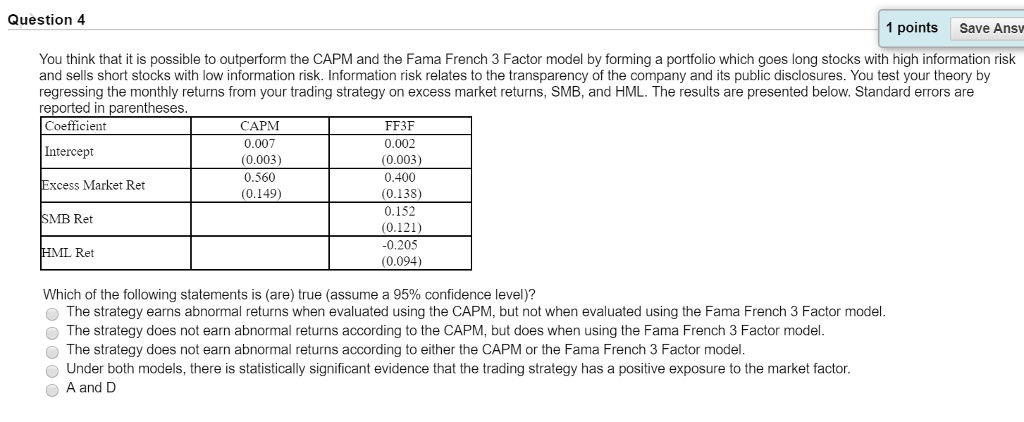

Question 4 1 points Save Ansv You think that it is possible to outperform the CAPM and the Fama French 3 Factor model by forming a portfolio which goes long stocks with high information risk and sells short stocks with low information risk. Information risk relates to the transparency of the company and its public disclosures. You test your theory by regressing the monthly returns from your trading strategy on excess market returns, SMB, and HML. The results are presented below. Standard errors are reported in parentheses Coefficient Intercept Excess Market Ret MB Ret HML Ret CAPM 0.007 (0.003) 0.560 (0.149) FF3F 0.002 (0.003) 0.400 0.138) 0.152 0.205 0.094) Which of the following statements is (are) true (assume a 95% confidence level)? The strategy earns abnormal returns when evaluated using the CAPM, but not when evaluated using the Fama French 3 Factor model. The strategy does not earn abnormal returns according to the CAPM, but does when using the Fama French 3 Factor model The strategy does not earn abnormal returns according to either the CAPM or the Fama French 3 Factor model Under both models, there is statistically significant evidence that the trading strategy has a positive exposure to the market factor. A and D

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts