Question: Question 4 1 points Save Answer Ewan Inc. is considering the purchase of a new machine for $12,000, installed. This machine is included in CCA

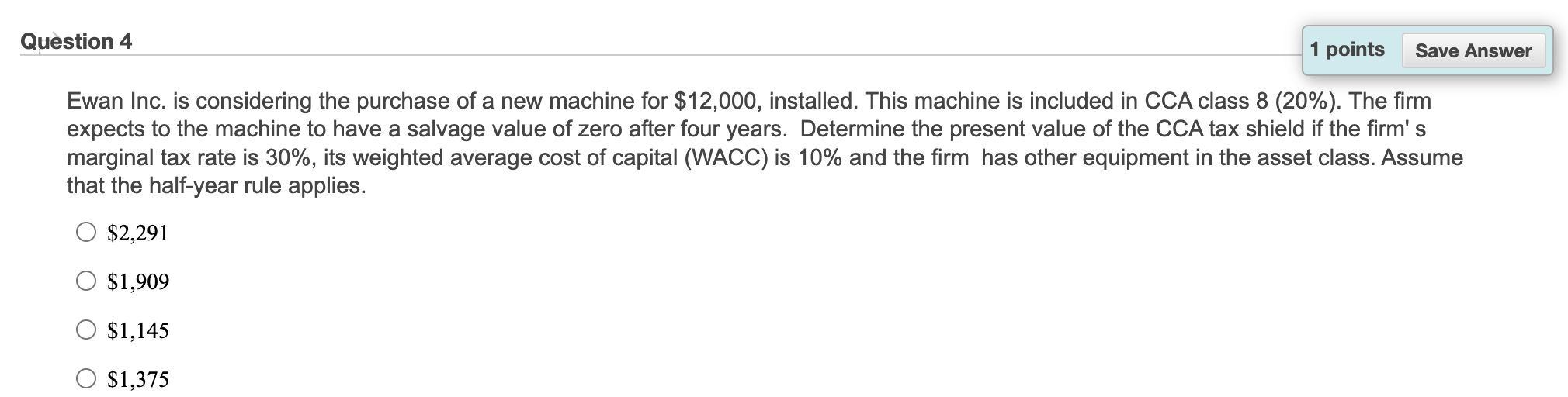

Question 4 1 points Save Answer Ewan Inc. is considering the purchase of a new machine for $12,000, installed. This machine is included in CCA class 8 (20%). The firm expects to the machine to have a salvage value of zero after four years. Determine the present value of the CCA tax shield if the firm's marginal tax rate is 30%, its weighted average cost of capital (WACC) is 10% and the firm has other equipment in the asset class. Assume that the half-year rule applies. $2,291 $1,909 $1,145 $1,375

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts